Summary

VIX Call Demand: Last week, implied volatilities declined across multiple asset classes as risk assets surged. However, the rally was short-lived as markets faced renewed pressure over the weekend due to concerns surrounding artificial intelligence (AI) and tariff-related news.

Despite a drop in the VIX Index by 1.1 points to 14.9%, demand for VIX options, especially upside calls, saw a significant increase.

Meanwhile, SPX skew initially flattened amid the rally, but heightened demand for out-of-the-money (OTM) puts pushed put skew higher.

Also Read: Short-Term Stock Investment 101: Your Essential Guide for 2024

Cross-Asset Volatility Trends

Implied volatilities across various asset classes saw a decline last week as risk assets experienced a brief rally. However, market sentiment reversed over the weekend, leading to increased uncertainty.

- Foreign Exchange (FX) Volatility: FX markets, particularly sensitive to tariff-related risks, experienced the most notable drop in volatility. The one-month implied volatility for G7 currencies declined from the 94th percentile to the 54th percentile.

- Oil Market Volatility: Crude oil volatility also declined, with WTI’s one-month implied volatility falling by 3.5 points to 30%, positioning it in the 36th percentile. However, put option demand for oil increased as prices continued to decline.

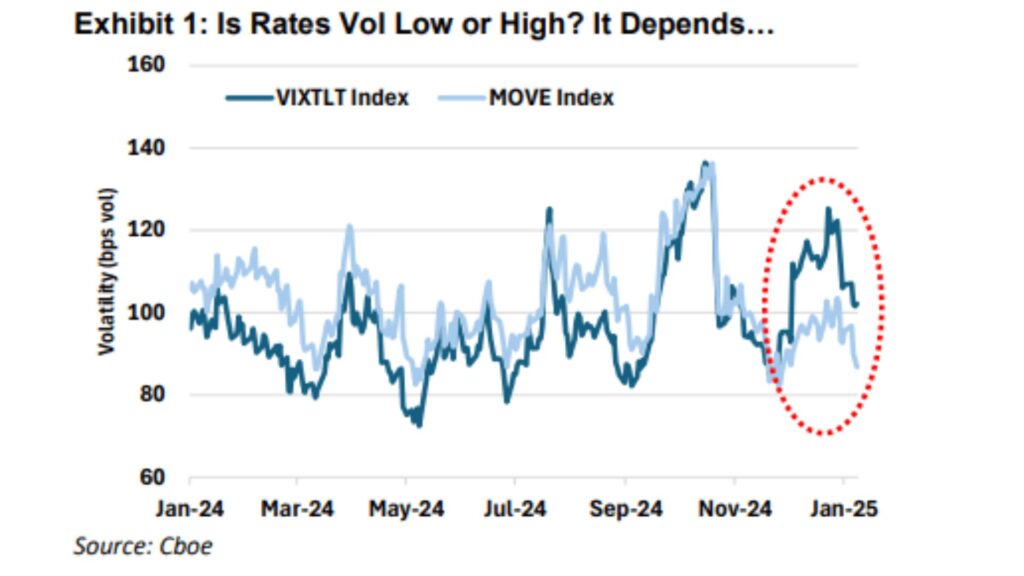

- Interest Rate Volatility: The MOVE Index, which tracks bond market volatility, dropped to a near one-year low ahead of the upcoming FOMC meeting. This decrease was primarily influenced by the short end of the yield curve, as the Federal Reserve is expected to maintain its stance until at least June.

- Long-Term Bond Volatility: In contrast, implied volatility for long-dated bonds, tracked by the VIXTLT Index (20+ Year Treasury Bond Volatility Index), remains elevated. Persistent concerns regarding inflation and fiscal/trade policies have contributed to this divergence. While the MOVE Index sits at the 4th percentile, VIXTLT remains in the 75th percentile, highlighting ongoing uncertainty in the bond market.

Equity Volatility and VIX Option Trends

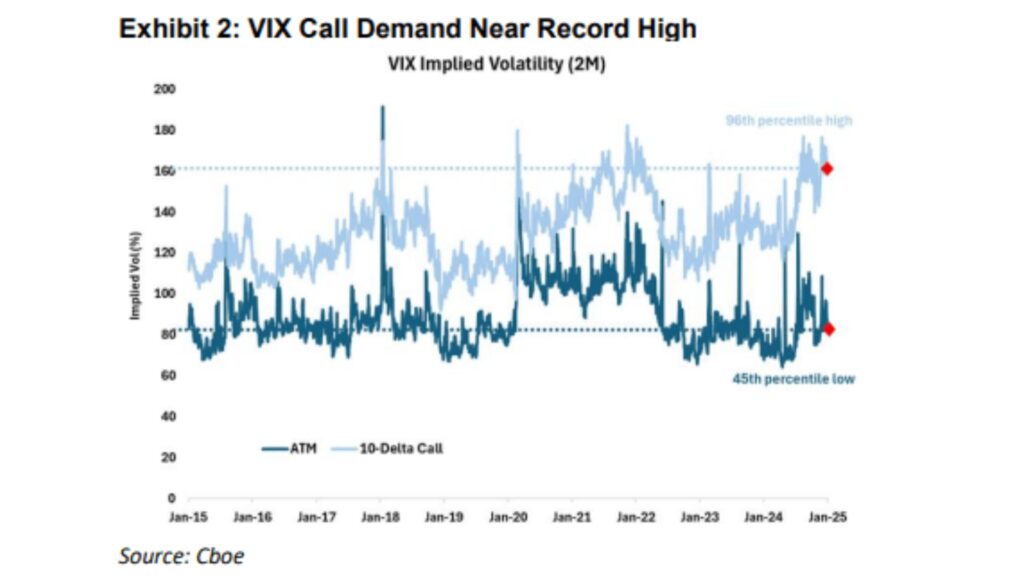

The VIX Call Demand Index recorded a 1.1-point decline to 14.9% last week. However, demand for VIX options, particularly upside calls, increased significantly:

- VIX Option Activity: The average daily volume (ADV) of VIX options in January reached 938,000 contracts—13% higher than last year’s record ADV of 830,000 contracts.

- Skew Dynamics: The surge in buying of VIX upside calls has driven VIX skew to near-record highs. Two-month skew (measured by the 25-delta call/put ratio) is currently in the 99th percentile, its highest level in the past decade.

- Market Sentiment: This shift in sentiment follows last month’s FOMC meeting, which triggered a sharp reaction in the VIX. While the two-month at-the-money (ATM) volatility for VIX remains relatively stable at 83% (45th percentile), the 10-delta OTM call options are trading at nearly double that, with a volatility of 162%—marking a 96th percentile high over the past 10 years.

SPX Skew and Market Positioning

While SPX skew flattened during last week’s market rally, demand for OTM puts increased, leading to a steepening of put skew.

- SPX Put Skew: The three-month SPX put skew (measured by the 10D/25D ratio) rose from the 75th percentile to the 86th percentile.

- Investor Risk Assessment: The rise in demand for SPX puts aligns with the growing demand for VIX options, suggesting that investors are pricing in higher tail risks. This may reflect increased caution due to the unpredictability of economic policies under the current administration.

Correlation and Dispersion Trends

As earnings season progresses, single-stock volatility is rising relative to the broader index. This trend is evident in the growing spread between VIXEQ (which tracks weighted single-stock volatility) and the VIX Index.

- Implied Dispersion: The DSPXSM Index, which measures implied dispersion, remains elevated at over 30%, indicating heightened divergence between individual stock movements and overall market trends.

Conclusion

Despite a decline in the VIX Call Demand Index last week, investor demand for VIX Call Demand has surged, reflecting heightened market uncertainty ahead of the FOMC meeting. Rising put skew and increased dispersion suggest that traders are hedging against potential volatility spikes, driven by economic policy concerns and global trade risks.

As the Federal Reserve prepares to outline its monetary policy stance, market participants will closely monitor volatility trends across asset classes for further insights into risk sentiment.

Also Read:

- 5StarsStocks.com Healthcare: Proven Strategies to Smart Stock Investment

- The Pros and Cons of Dividend Stocks in a Volatile Market

- Fintechzoom PLTR Stock: A Comprehensive Analysis for Investors