In today’s complex financial landscape, effectively managing your finances is more crucial than ever. Top free personal finance software provides a powerful solution, offering robust tools for tracking expenses, managing budgets, and achieving financial goals—all at no cost.

These platforms are essential for anyone looking to unlock their financial potential and enhance their fiscal well-being. By leveraging these tools, you can take a significant step towards achieving financial stability and growth.

Key Takeaways

- Transform Your Financial Management: Discover how top free personal finance software can revolutionize your approach to budgeting and expense tracking.

- Understand the Benefits: Learn about the critical advantages these tools offer in managing personal finances.

- Strategic Financial Planning: See how integrating these tools into your routine can be a strategic move toward unlocking your financial potential.

- Personalized Financial Solutions: Gain insights into selecting the right software based on your unique financial situation to maximize its benefits.

- Embrace Technological Advancements: Explore the impact of technology on financial planning and the importance of staying updated with the latest tools.

The Benefits of Top Free Personal Finance Software

The increasing popularity of free personal finance software highlights its transformative impact on financial management. These tools simplify complex tasks and make financial tracking more accessible and user-friendly.

Advantages of Free Personal Finance Software:

- Enhanced Accessibility: Access your financial information from anywhere at any time, making it easier to make informed decisions quickly.

- Reduced Errors: Minimize errors in financial management with accurate budgeting and expense tracking.

- Customizable Features: Adjust the software to meet your specific financial needs, with features like interactive budgets and visual spending trackers.

- Insightful Analytics: Gain valuable insights into your spending habits, helping you to refine your money management strategies.

Feature vs. Advantage:

| Feature | Advantage |

|---|---|

| Budget Creation | Customizable templates simplify the budgeting process. |

| Expense Tracking | Automatic categorization of expenses for easy review. |

| Financial Goals | Encryption to protect your financial data. |

| Data Security | Encryption to protect your personal financial data. |

| Reporting | Detailed reports to better understand and improve spending habits. |

While the quality of free personal finance software can vary, the benefits they offer can significantly enhance financial stability and success.

By adopting these tools, users gain insights and control that were once available only through professional financial services.

Simplifying Budgeting and Expense Tracking with Free Software

Managing finances should not be a cumbersome task involving endless paperwork or manual calculations. Free budgeting and expense-tracking software streamline these processes, making financial management more efficient and transparent.

Streamlining Monthly Budgeting

A well-structured monthly budget is vital for maintaining financial health. Free personal finance software simplifies budget creation by auto-generating frameworks based on your income and expenses.

This feature makes it easier to allocate funds toward various financial goals. Expense categorization provides a clear overview of spending, highlighting areas where you can save.

Visual tools such as charts and graphs offer insights into spending patterns, helping you adjust expenses to align with your financial priorities. Automation reduces the time spent on manual tracking, allowing you to focus more on improving your financial situation.

Real-Time Expense Tracking

Real-time tracking of expenses is another significant benefit of free budgeting software. This feature enhances accountability and provides immediate insights into each transaction’s impact. Instant updates on transactions help prevent budget errors and impulsive purchases.

Alerts for potential overspending or unusual activity enable prompt adjustments, ensuring you stay within your financial limits.

Real-time data allows for rapid adaptation to financial changes, fostering a proactive approach to money management. This adaptability is especially valuable in today’s unpredictable financial environment.

Best Free Personal Finance Software for Effective Money Management

Selecting the right free personal finance software is crucial for effective money management. The following software options stand out for their robust features and their ability to improve financial well-being:

1. GnuCash

GnuCash is a free personal and small-business financial accounting software that operates on various operating systems, including GNU/Linux, BSD, and Solaris. It uses a double-entry bookkeeping system and features a user-friendly checkbook-like register for tracking bank accounts, stocks, income, and expenses.

GnuCash caters to those with a deeper understanding of finance. It uses double-entry accounting to provide a thorough ledger and customizable options for a range of financial tasks. GnuCash is particularly useful for users who need detailed financial reporting and advanced management capabilities.

2. Mint

Mint refers to a few different contexts, but in recent discussions, it often refers to Linux Mint, which is an operating system for desktop and laptop computers that comes pre-loaded with essential applications. It’s designed to be user-friendly and to work ‘out of the box’.

It could also relate to business or financial news publication sources like Mint, which covers the latest developments in finance, stock markets, and businesses in India and worldwide. Please clarify your specific interest regarding “Mint” for more precise information.

Mint offers comprehensive features for budgeting, expense tracking, and financial goal setting. It automatically categorizes expenses, tracks investments in real-time, and provides free credit score updates.

Its intuitive design and real-time investment tracking help users stay informed and proactive about their finances.

3. Personal Capital

Personal Capital is an online financial advisor and wealth management company based in Redwood Shores, California. They offer tools to help users manage their finances, and they have recently partnered with Empower, a large retirement planning company, to enhance their services.

Personal Capital excels in daily finance tracking and wealth management. It offers tools for retirement planning, investment analysis, and tracking net worth. This software is ideal for users seeking to manage their wealth and plan for long-term financial goals.

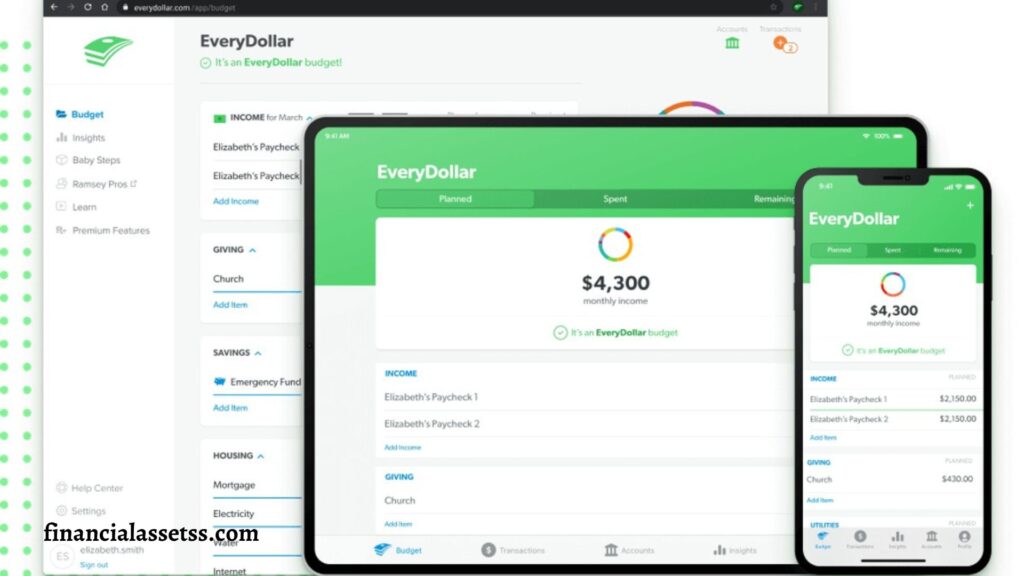

4. EveryDollar

EveryDollar is a personal budgeting app that allows you to create custom budgets, track your expenses, plan your spending, and set personal financial goals. It provides an easy-to-use, zero-based budgeting approach, helping you manage your money effectively anytime and anywhere.

EveryDollar follows a zero-based budgeting approach, helping users allocate every dollar to a specific expense or savings goal. This method promotes precise fund allocation and effective money management, aligning with Dave Ramsey’s financial principles.

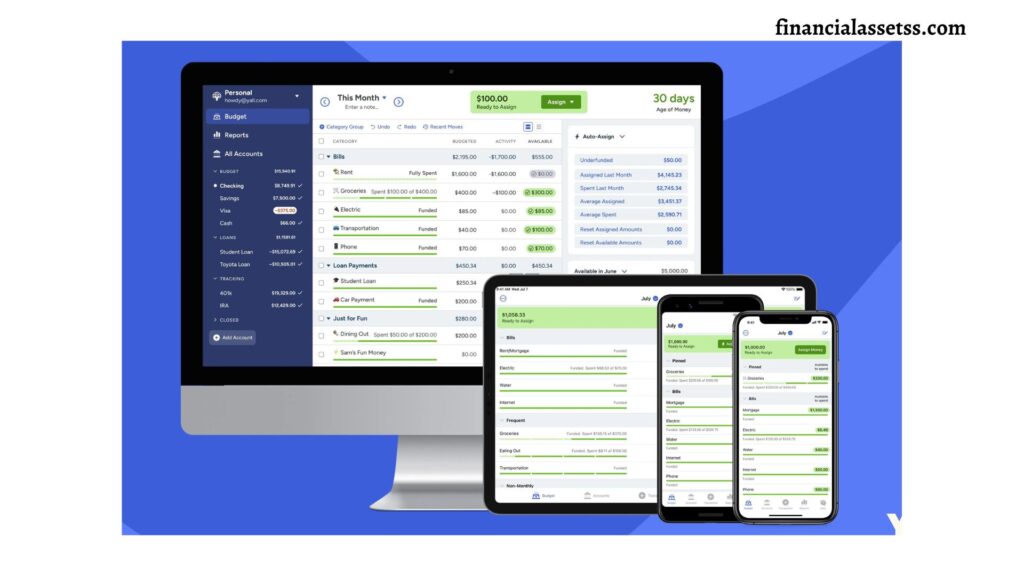

5. YNAB (You Need A Budget)

YNAB, which stands for You Need A Budget, is a personal finance management tool designed to help users organize their finances, reduce stress about money, stop financial arguments, pay off debt, and save more effectively.

It focuses on active cash flow management and encourages users to adjust their budget actively rather than setting it and forgetting it.

YNAB emphasizes proactive budgeting by assigning each dollar a specific task. Its approach aids in reducing debt and building savings through detailed budgeting techniques. YNAB’s philosophy encourages financial accountability and goal tracking.

Software Feature Comparison Table:

| Software | Key Features | Unique Offerings |

|---|---|---|

| Mint | Comprehensive budgeting, expense tracking, credit score updates | Real-time investment tracking, user-friendly dashboard |

| GnuCash | Double-entry accounting, detailed financial ledger | High customizability, advanced financial reporting |

| Personal Capital | Daily tracking, wealth management tools | Retirement planner, investment checkup |

| EveryDollar | Zero-based budgeting | Direct fund allocation, Ramsey Baby Steps integration |

| YNAB | Proactive budgeting, debt reduction | Financial accountability, goal tracking |

These software options offer a range of features for tracking spending, visualizing financial goals, and making informed decisions, all at no cost.

Managing Debt with Free Financial Tools

Effective debt management is a critical component of financial planning. Free personal finance software plays a vital role in analyzing debt and devising strategies for becoming debt-free.

Analyzing Debt with Digital Solutions

Understanding your debt is the first step towards effective management. Digital tools simplify this process by breaking down debt into manageable segments, analyzing balances, interest rates, and payment schedules.

This clarity enables informed decision-making regarding debt repayment.

Strategies for Effective Debt Payoff

1. Snowball Method: Focus on paying off smaller debts first to build momentum and achieve psychological victories. This approach provides a sense of progress and motivation.

2. Avalanche Method: Prioritize debts with the highest interest rates to save money on interest over time. This method is cost-effective and helps reduce the overall debt burden more quickly.

3. Extra Payments: Allocate additional funds towards debt repayment beyond the regular schedule. This strategy shortens the repayment timeframe and reduces total interest paid.

Strategy Comparison Table:

| Strategy | Description | Benefits |

|---|---|---|

| Snowball Method | Pay off smaller debts first to gain momentum. | Provides psychological wins and a sense of progress. |

| Avalanche Method | Target debts with the highest interest rates first. | Saves money on interest over time. |

| Extra Payments | Make additional payments towards debt outside the regular schedule. | Reduces overall interest and shortens repayment time. |

Implementing these strategies with discipline and personalization is essential for achieving a debt-free life.

Optimizing Savings and Investments with Financial Apps

Modern technology has introduced features like Savings Optimizers and Investment Aids, enhancing how we save and invest.

Automated Savings Calculation

Automated Savings Calculation helps users develop effective savings strategies by analyzing monthly income, expenses, and financial goals. This customization leads to a more efficient savings plan tailored to individual needs.

Investment Portfolio Suggestions

Personal finance apps now offer Investment Portfolio Suggestions based on risk tolerance, investment timelines, and goals.

This guidance helps users make informed investment decisions and build a strong portfolio aligned with their financial objectives.

Feature Comparison Table:

| Feature | Description | Benefits |

|---|---|---|

| Savings Optimizer | Identifies optimal saving opportunities automatically. | Maximizes savings potential tailored to individual circumstances. |

| Automated Savings Calculation | Calculates ideal savings amounts based on personal data. | Creates personalized savings plans that adapt to financial changes. |

| Investment Portfolio Suggestions | Provides investment recommendations based on user profiles. | Offers expert guidance for building a strong investment portfolio. |

These features empower users to take control of their finances, optimize savings, and secure their financial future.

Integrating Wealth Growth Strategies with Personal Finance Platforms

Integrating personal finance platforms with wealth growth strategies is crucial for achieving long-term financial goals. These tools provide a solid foundation for managing finances and exploring wealth-building opportunities.

Setting and Achieving Financial Goals

Personal finance platforms facilitate goal setting and tracking, making it easier to achieve milestones such as buying a home, funding education, or retiring comfortably.

These tools help users establish realistic goals and monitor their progress effectively.

Maximizing Wealth Growth Opportunities

Tracking finances alone is not enough for wealth growth. Personal finance platforms offer insights into investment opportunities, helping users identify options that match their financial capacity and risk tolerance.

This opens doors to savings and investment opportunities that can significantly impact long-term wealth accumulation.

Strategy Comparison Table:

| Strategy | Tools and Features | Expected Outcome |

|---|---|---|

| Automated Saving | Budgeting tools, Automated transfers | Consistent increase in savings. |

| Debt Reduction | Debt payoff calculators, Payment reminders | Reduced interest costs, faster debt pay-off. |

| Investment Analysis | Risk assessment tools, Portfolio management | Better investment choices and growth. |

Advanced analytics and customizable alerts provided by financial software offer a competitive edge in managing finances, paving the way for financial independence and success.

Conclusion

In this detailed exploration of free personal finance software, we’ve examined how these tools can transform budgeting, expense tracking, debt management, and investment growth.

By leveraging top free personal finance software, you can effectively manage your finances, gain control over your financial future, and achieve your financial goals.

Embracing these technological advancements is a crucial step toward responsible financial management. The integration of finance and technology provides extensive features and ease of use, opening doors to financial empowerment.

Start utilizing these digital tools today to master your financial story and set yourself on a path to financial success.

FAQs: Top Free Personal Finance Software

1. What is personal finance software?

Personal finance software helps individuals manage their financial activities, including budgeting, tracking expenses, managing investments, and planning for future financial goals.

2. How can free personal finance software help me?

Free personal finance software provides essential tools for budgeting, expense tracking, and goal setting without any cost.

3. Are there limitations to using free personal finance software?

While free personal finance software offers many valuable features, some limitations may include fewer advanced functionalities compared to paid versions, potential for limited customer support, and less integration with other financial tools or institutions.

4. How do I choose the right personal finance software for my needs?

To choose the right personal finance software, consider your specific financial goals, the features you need (such as budgeting, expense tracking, or investment management), and the software’s ease of use.

5. Is my financial data secure with free personal finance software?

Most reputable free personal finance software platforms use encryption and other security measures to protect your financial data. However, it’s essential to choose software from trusted providers and ensure that they have robust security protocols in place.

6. Can I use free personal finance software for business finances?

Free personal finance software is typically designed for personal use and may not offer the advanced features needed for business finances.

7. How often should I update my financial data in the software?

For the best results, update your financial data regularly. Ideally, you should enter new transactions and review your budget and expenses at least once a week.