Expenses Tracking Tools and Apps: Keeping track of your expenses is the foundation of financial success. Whether you’re looking to stick to a budget, cut unnecessary spending, or save for the future, using the right expenses tracking tools and apps can make all the difference.

With so many financial tracking apps available, it can be overwhelming to choose the best one. That’s why we’ve compiled a list of the top-rated tools and apps to help you monitor your spending, categorize transactions, and stay in control of your finances.

Also Read: 50 Smart Frugal Living Tips to Save Money Without Sacrificing Quality of Life

Why You Should Track Your Expenses

Before diving into the best apps, let’s first understand why tracking your expenses is crucial:

Prevents Overspending – Helps you see where your money is going and avoid impulse purchases.

Identifies Spending Patterns – Gives insights into your habits so you can cut unnecessary expenses.

Encourages Savings – Knowing where you overspend allows you to redirect money to savings or investments.

Improves Budgeting – Helps you stick to a budget and manage debt more effectively.

Reduces Financial Stress – With clear financial tracking, you feel more in control of your money.

Top 10 Best Expenses Tracking Tools and Apps Must Know

Here are some of the best expenses tracking tools and apps for different financial needs, whether you’re budgeting, investing, or managing family expenses.

1. Mint – Best Overall Free Expense Tracker

Best for: Beginners, overall expense tracking

Cost: Free

Mint is one of the most popular and comprehensive budgeting apps, making it a great choice for tracking expenses, monitoring bills, and setting financial goals.

Key Features:

- Automatically syncs with your bank accounts, credit cards, and bills

- Categorizes transactions and provides spending insights

- Alerts for due payments and low balances

- Free credit score monitoring

Pros:

Easy to use and beginner-friendly

Comprehensive budget tracking

Free to use

Cons:

Ads and promotions can be annoying

Some users report syncing issues with banks

Available on: iOS, Android, Web

2. YNAB (You Need A Budget) – Best for Zero-Based Budgeting

Best for: Those serious about budgeting and saving

Cost: $14.99/month or $99/year (34-day free trial)

YNAB follows the zero-based budgeting method, where every dollar has a job. It’s perfect if you want to actively manage your finances rather than just track them.

Key Features:

- Helps assign every dollar to a category

- Real-time syncing across devices

- Debt payoff planning and goal tracking

- Detailed reports and financial insights

Pros:

Helps users save money fast

Great for debt payoff and financial planning

No ads or promotions

Cons:

Monthly fee might not be ideal for casual users

Has a learning curve for beginners

Available on: iOS, Android, Web

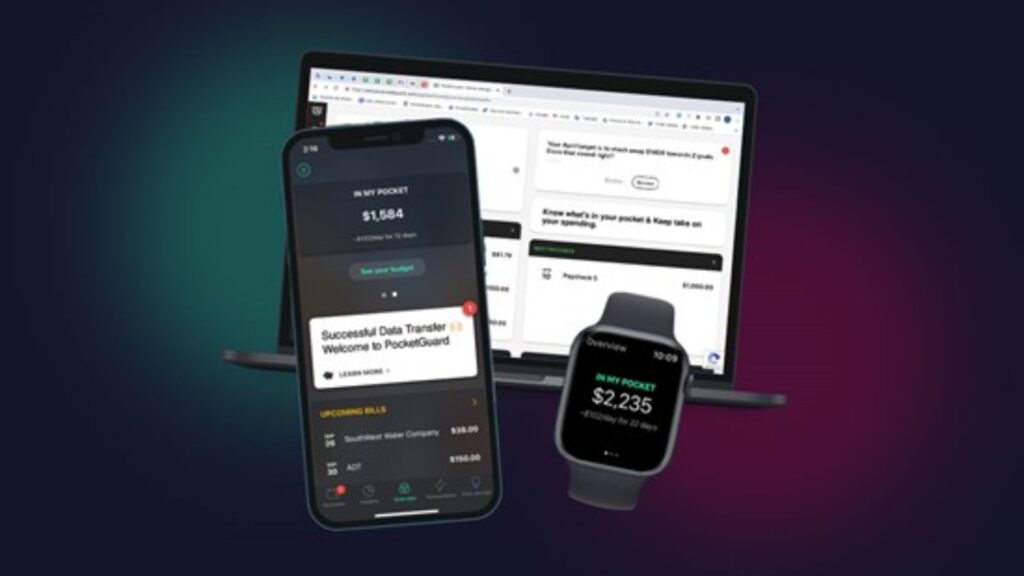

3. PocketGuard – Best for Preventing Overspending

Best for: People who tend to overspend

Cost: Free (PocketGuard Plus: $7.99/month or $79.99/year)

PocketGuard makes budgeting simple by telling you how much money is safe to spend after covering bills, savings, and goals.

Key Features:

- Analyzes your income, bills, and spending

- Shows how much you can safely spend

- Helps lower bills by identifying unnecessary subscriptions

- Tracks financial goals

Pros:

Easy-to-use interface

Helps prevent overspending

Subscription cancellation feature

Cons:

Fewer advanced budgeting tools than YNAB or Mint

Free version has limitations

Available on: iOS, Android, Web

Also Read: 8 Financial Management Skills of Students: 5th One Is Mind Blowing

4. Personal Capital – Best for Tracking Net Worth & Investments

Best for: Investors, wealth tracking

Cost: Free (Wealth management services available for a fee)

Personal Capital is a powerful financial management tool that tracks expenses, budgets, and investments. It’s ideal for those who want a complete financial overview, including net worth tracking.

Key Features:

- Tracks spending, cash flow, and investments

- Net worth calculator

- Retirement and savings planning tools

- Asset allocation insights

Pros:

Best free tool for tracking wealth & net worth

Comprehensive investment insights

Free financial planning tools

Cons:

Not focused on day-to-day budgeting

Investment services can be expensive

Available on: iOS, Android, Web

5. Goodbudget – Best for Envelope Budgeting

Best for: People who love cash-based budgeting

Cost: Free (Premium: $8/month or $70/year)

Goodbudget is a digital version of the envelope budgeting system, where you divide money into virtual envelopes for different spending categories.

Key Features:

- Virtual envelope system for budgeting

- Tracks spending across multiple devices

- Ideal for couples and families sharing a budget

Pros:

Great for cash-based budgeting fans

Encourages disciplined spending

Works well for household budgeting

Cons:

Doesn’t sync with bank accounts automatically

Requires manual entry of transactions

Available on: iOS, Android, Web

6. Rocket Money (Formerly Truebill) – Best for Managing Subscriptions

Best for: Canceling unused subscriptions, bill negotiation

Cost: Free (Premium: $3-$12/month)

Rocket Money is perfect for people who struggle with recurring expenses. It helps users track spending, negotiate bills, and cancel unwanted subscriptions effortlessly.

Key Features:

- Tracks all subscriptions and recurring payments

- Cancels unwanted subscriptions with one click

- Negotiates lower bills for services like cable and internet

- Budgeting and spending analysis

Pros:

Great for reducing unnecessary expenses

Easy to use with automation features

Personalized bill negotiation service

Cons:

Premium features require a subscription

Limited budgeting tools compared to Mint or YNAB

Available on: iOS, Android

7. Wally – Best for Manual Expense Tracking

Best for: People who prefer manual budgeting

Cost: Free (Premium features available)

Wally is a simple yet powerful app for users who prefer manually tracking their expenses instead of relying on bank syncs. It’s great for those who want more control over data privacy.

Key Features:

- Tracks income and expenses manually

- Supports multiple currencies for travelers

- Generates spending insights

- No need to link bank accounts

Pros:

Best for hands-on budgeters

Simple and privacy-focused

Ideal for international users

Cons:

Manual entry may be time-consuming

Fewer automation features than Mint or PocketGuard

Available on: iOS, Android

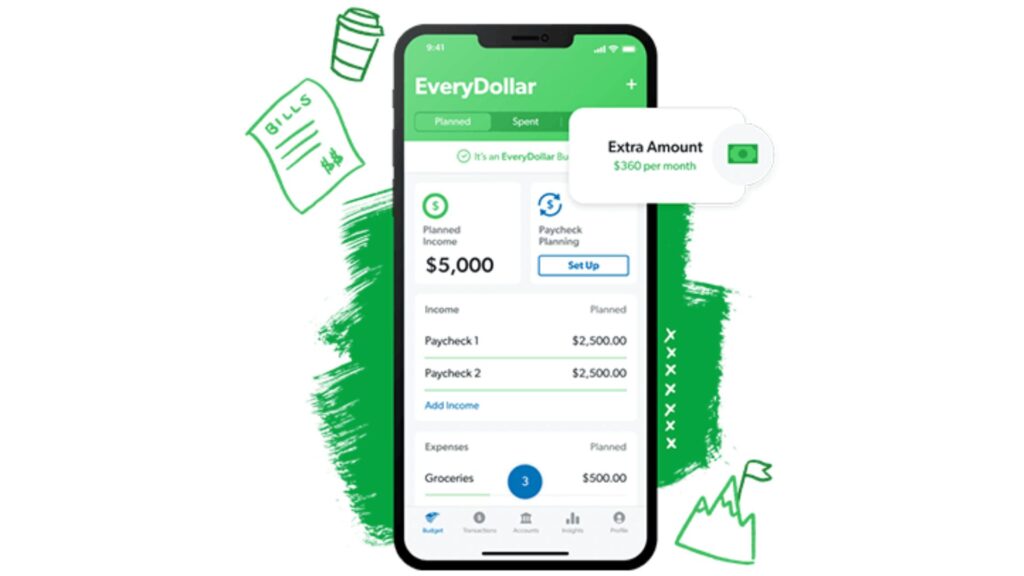

8. EveryDollar – Best for Dave Ramsey Fans & Debt Payoff

Best for: Zero-based budgeting and debt repayment

Cost: Free (EveryDollar Plus: $12.99/month or $79.99/year)

Created by Dave Ramsey, EveryDollar follows the zero-based budgeting method, which ensures every dollar is assigned a purpose. It’s an excellent choice for debt-free living.

Key Features:

- Uses zero-based budgeting principles

- Tracks monthly expenses and income

- Syncs with bank accounts (Premium)

- Helps users stick to the Baby Steps debt payoff plan

Pros:

Great for getting out of debt

Ideal for Dave Ramsey followers

Simple, easy-to-use interface

Cons:

Free version requires manual entry

Limited automation features

Available on: iOS, Android, Web

9. Spendee – Best for Couples & Shared Budgets

Best for: Families, couples, and shared finances

Cost: Free (Premium: $2.99/month or $22.99/year)

Spendee is a great budgeting tool for couples and families who want to track expenses together. It allows users to create shared wallets for managing household expenses.

Key Features:

- Allows shared financial tracking

- Syncs with bank accounts for real-time expense tracking

- Custom budget categories

- Great for vacation or wedding budgeting

Pros:

Best for managing money with a partner

User-friendly interface

Helps plan shared expenses

Cons:

Free version has limited features

No investment tracking

Available on: iOS, Android

10. Toshl Finance – Best for Visual Expense Tracking

Best for: People who prefer visual budgeting tools

Cost: Free (Pro: $2.99/month or $19.99/year)

Toshl Finance is a fun and interactive budgeting app that makes expense tracking visually engaging. It’s great for people who prefer graphs, charts, and infographics over spreadsheets.

Key Features:

- Connects to 13,000+ banks worldwide

- Custom financial reports with graphs

- Expense forecasting

- Supports multiple currencies

Pros:

Best visual tracking interface

Great for international users

Easy-to-use graphs and reports

Cons:

Free version has limited features

No investment tracking tools

Available on: iOS, Android, Web

How to Pick the Right Expenses Tracking Tools and Apps

Still not sure which app is best for you? Here’s a quick comparison:

| Need | Best App |

|---|---|

| Best free overall tracker | Mint |

| Best for budgeting & debt-free living | YNAB, EveryDollar |

| Best for cutting subscriptions & negotiating bills | Rocket Money |

| Best for manual tracking & privacy | Wally |

| Best for couples & shared budgets | Spendee |

| Best for visual budgeting & international users | Toshl Finance |

Final Thoughts

Expenses Tracking Tools and Apps is an essential step toward financial stability. Whether you need simple budgeting, bill tracking, or investment monitoring, there’s an app that fits your needs.

By choosing the right expenses tracking tools and apps, you’ll gain better financial control, reduce stress, and achieve your savings goals faster.

Friends, in this post we have discussed about the Expenses Tracking Tools and Apps! i hope this article will help you and clear your all doubts related to this.

Which expense tracker do you use? Let us know in the comments!

FAQs About Expenses Tracking Tools and Apps

1. Why should I use an expense tracking app?

An expense tracking app automates budgeting, categorizes spending, and helps you stay financially organized. It prevents overspending, increases savings, and provides real-time insights into your financial habits.

2. What is the best free expense tracking app?

Mint is widely considered the best free expense tracking app because it syncs with bank accounts, categorizes spending, and provides financial insights. Other good free options include PocketGuard, Rocket Money, and Wally.

3. Are these budgeting apps safe to use?

Yes! Most reputable apps like Mint, YNAB, and Personal Capital use bank-level encryption to protect your data. Always choose apps with strong security policies and two-factor authentication for extra safety.

4. Do these apps sync with my bank accounts?

Yes, most apps like Mint, PocketGuard, and YNAB sync with bank accounts, credit cards, loans, and investment accounts for real-time tracking. However, some apps like Wally and Goodbudget allow manual entry for privacy-conscious users.

5. What is the best app for tracking shared expenses with a partner?

Spendee is great for couples or roommates who need to track shared finances. It allows users to create shared wallets for budgeting together. Goodbudget also works well for families following the envelope budgeting system.

6. Which app is best for people who overspend?

If you struggle with overspending, PocketGuard is a great choice because it shows how much money is safe to spend after covering bills, savings, and goals. Rocket Money is also helpful for canceling unnecessary subscriptions.

7. Which app is best for tracking both spending and investments?

Personal Capital is the best app for tracking both everyday expenses and long-term investments. It helps users manage spending, track net worth, and optimize investments.

8. What is the best expense tracker for beginners?

Mint is the best app for beginners because it is easy to use, free, and automatically categorizes transactions. PocketGuard is another beginner-friendly option for simplified budgeting.

Disclaimer: This post is not sponsored by any of the apps or tools mentioned. The recommendations are based on independent research and user reviews to help readers find the best expense-tracking solutions. Always conduct your own research before choosing a financial tool.

Also Read:

- 11 Proven Ways to Build Good Financial Habits for Young Adults

- How AI is Changing Personal Finance Management: 11 Powerful Ways

- Expert Risk Management Solutions for Every Industry: 5 Proven Strategies

- 10 Smart Budgeting Hacks to Save More Money Each Month