Importance of Financial Literacy: Building wealth is more than just stashing away a portion of your paycheck; it’s about creating a solid financial foundation and using strategic planning to grow your assets over time.

Financial literacy plays a pivotal role in this process, providing the knowledge and skills needed to make informed decisions about saving, investing, and managing money.

This comprehensive guide will explore the Importance of Financial Literacy in wealth building and offer actionable strategies to help you achieve your financial goals.

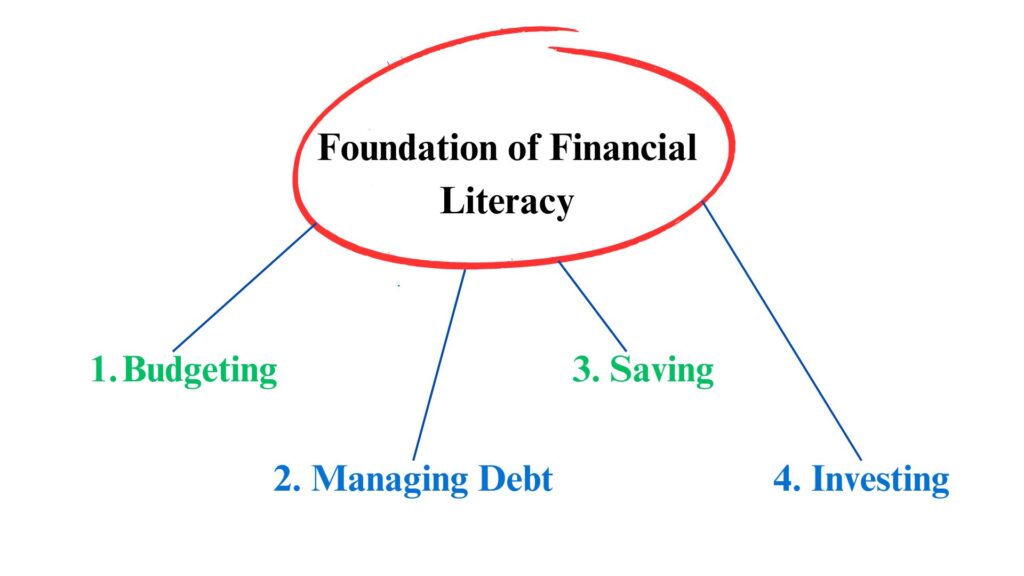

The Foundation of Financial Literacy

Importance of Financial Literacy: Financial literacy encompasses the knowledge and skills needed to make informed financial decisions. It involves understanding how money works, how to manage it effectively, and how to make it work for you.

For wealth building, financial literacy is crucial because it helps you:

- Set Realistic Goals: Understand what you want to achieve and how to set measurable, achievable objectives.

- Develop a Strategic Plan: Create a roadmap for reaching your financial goals.

- Make Informed Decisions: Choose the right savings and investment options to maximize your returns and minimize risks.

By mastering these fundamental concepts, you can lay the groundwork for a successful wealth-building strategy.

1. Setting Thoughtful Financial Goals

Defining Your Objectives

Importance of Financial Literacy: The first step in building wealth is to define what you want to achieve. Your goals should be specific, measurable, achievable, relevant, and time-bound (SMART). Here are some common financial goals and how to approach them:

- Retirement Planning: Determine how much you need to retire comfortably. Consider factors like your desired lifestyle, life expectancy, and inflation. Use retirement calculators to estimate the amount you need to save each month to reach your target.

- Homeownership: If buying a home is on your horizon, calculate the down payment required, ongoing mortgage payments, and additional costs like property taxes and maintenance. Set a savings goal to cover these expenses.

- Education Savings: For those planning to fund education, estimate the cost of tuition, books, and other expenses. Explore education savings accounts like 529 plans or Coverdell ESAs to maximize your savings.

- Charitable Giving: If you aim to support charitable causes, set a budget for donations and explore options for philanthropic giving that align with your values.

Creating Milestones

Break your primary goal into smaller, manageable milestones. For instance, if you aim to save $50,000 for a down payment in five years, set annual and monthly savings targets. Regularly review your progress and adjust your plan as needed.

2. Developing Smart Saving Strategies

Choosing the Right Savings Account

A well-chosen savings account can significantly impact your financial growth. Consider the following types of accounts:

- High-Yield Savings Accounts: These accounts offer higher interest rates compared to traditional savings accounts, allowing your money to grow more quickly. Look for accounts with competitive rates and minimal fees.

- Certificates of Deposit (CDs): CDs typically offer higher interest rates than savings accounts but require you to lock in your money for a fixed term. They’re a good option for funds you don’t need immediate access to.

- Money Market Accounts: These accounts often provide higher interest rates and offer limited check-writing abilities. They’re a suitable choice for short-term savings goals.

Building an Emergency Fund

Importance of Financial Literacy: An emergency fund is essential for financial stability. Aim to save three to six months’ worth of living expenses to cover unexpected costs like medical emergencies or car repairs. Keep this fund in a liquid, easily accessible account.

Increasing Contributions

As your income grows, increase your savings contributions. Automate your savings by setting up automatic transfers to your savings or investment accounts.

This “pay yourself first” approach ensures you consistently save without having to think about it.

3. Investing Wisely for Long-Term Growth

Understanding Investment Options

Investing is crucial for building wealth, as it offers the potential for higher returns compared to traditional savings methods. Here’s a breakdown of common investment options:

- Stocks: Buying stocks means purchasing a share of a company’s ownership. Stocks have the potential for high returns but come with higher risk. Diversify your stock investments to mitigate individual company risks.

- Bonds: Bonds are debt securities issued by governments or corporations. When you invest in bonds, you’re essentially lending money in exchange for regular interest payments. Bonds are generally lower risk than stocks but offer lower returns.

- Mutual Funds and ETFs: These investment vehicles pool money from multiple investors to buy a diversified portfolio of stocks, bonds, or other assets. They provide diversification and professional management, making them a good option for beginners.

- Real Estate: Investing in property can provide rental income and potential appreciation. Real estate investments require substantial capital and involve property management responsibilities.

Also Read: Money6x Investment Trusts: A Path to Financial Success

Creating a Balanced Portfolio

A balanced portfolio includes a mix of asset classes to manage risk and optimize returns. Consider your risk tolerance, investment horizon, and financial goals when constructing your portfolio.

Regularly review and rebalance your investments to maintain your desired asset allocation.

Long-Term vs. Short-Term Investments

- Long-Term Investments: Focus on investments with the potential for growth over several years or decades, such as stocks or real estate. Long-term investments can weather market volatility and compound over time.

- Short-Term Investments: These are suitable for goals within the next few years. Consider options like high-yield savings accounts or short-term bonds for short-term goals.

4. The Impact of Compound Interest and Time

Harnessing the Power of Compound Interest

Importance of Financial Literacy: Compound interest is the process of earning interest on both the initial principal and the accumulated interest. This “interest on interest” effect can significantly boost your savings and investments over time. Start investing early to maximize the benefits of compound interest.

The Importance of Time

Time is a crucial factor in wealth building. The earlier you start saving and investing, the more time your money has to grow. Even small, consistent contributions can lead to substantial growth due to compounding.

5. The Role of Financial Advisors and Tools

When to Seek Professional Help

Financial advisors can provide personalized advice based on your unique financial situation and goals. They can help you develop a comprehensive financial plan, choose appropriate investments, and navigate complex financial decisions.

Using Financial Tools and Apps

Take advantage of financial tools and apps to manage your finances effectively. Budgeting apps, investment trackers, and retirement calculators can help you stay on track and make informed decisions.

6. Common Pitfalls to Avoid

Living Beyond Your Means

Importance of Financial Literacy: Avoid overspending and accumulating debt. Create a budget to track your income and expenses, and ensure you live within your means. Use credit responsibly and pay off high-interest debt as quickly as possible.

Neglecting to Plan for Taxes

Understand the tax implications of your investments and financial decisions. Tax-efficient investment strategies, such as using tax-advantaged accounts, can help you minimize your tax burden.

Failing to Reevaluate Goals and Plans

Regularly review and adjust your financial goals and plans. Life circumstances, market conditions, and financial goals can change, so it’s essential to stay flexible and adapt your strategies as needed.

Conclusion

Importance of Financial Literacy: Financial literacy is the cornerstone of successful wealth building. By understanding the principles of setting goals, saving smartly, investing wisely, and leveraging compound interest, you can build a solid foundation for long-term financial success.

Whether you’re just starting or looking to refine your strategy, improving your financial literacy will empower you to make informed decisions and secure a prosperous future.

Remember, the journey to wealth building is a marathon, not a sprint. Stay committed to your goals, continuously educate yourself, and take proactive steps to manage and grow your finances. With the right knowledge and strategies, you can achieve financial security and build lasting wealth.

FAQs: Importance of Financial Literacy

1. What is financial literacy and why is it important for wealth building?

Financial literacy involves understanding and managing money effectively. It helps set realistic goals, develop strategic plans, and make informed financial decisions, which are essential for growing wealth over time.

2. How should I set financial goals?

Define goals using the SMART criteria: Specific, Measurable, Achievable, Relevant, and Time-bound. For example, set targets for retirement savings, homeownership, or education, and break these into smaller milestones.

3. What types of savings accounts are recommended?

High-yield savings accounts, certificates of deposit (CDs), and money market accounts are recommended. Each offers different benefits, such as higher interest rates or liquidity, suitable for various financial goals.

4. Why is an emergency fund important?

An emergency fund, typically covering three to six months’ worth of expenses, is crucial for financial stability. It provides a safety net for unexpected costs, reducing the need for high-interest debt.

5. What are the main types of investments?

Common investment options include stocks, bonds, mutual funds, ETFs, and real estate. Each has varying risk levels and potential returns, making diversification key to managing investment risk.

6. What is compound interest and why should I start investing early?

Compound interest means earning interest on both the principal and accumulated interest. Starting early maximizes its benefits, as money grows exponentially over time, enhancing long-term financial growth.