FintechZoom Rivian Stock: Rivian Automotive, Inc. has emerged as a prominent player in the electric vehicle (EV) industry, capturing the attention of investors, tech enthusiasts, and eco-conscious consumers alike.

This article leverages insights from Fintechzoom—a leading financial analysis platform—to examine Rivian stock, covering its market performance, technological advancements, and overall investment potential.

Understanding Rivian’s stock dynamics is crucial for investors navigating the volatile EV market. Founded in 2009, Rivian has experienced a remarkable journey, transitioning from an ambitious startup to a publicly traded company with significant growth aspirations.

This analysis provides a comprehensive view of Rivian’s financial health, market positioning, and prospects. As the electric vehicle market expands, following Rivian’s trajectory offers valuable insights into broader trends in transportation and energy.

By the end of this article, readers will grasp why “Fintechzoom Rivian Stock” is a pivotal topic among investors and market analysts. Join us as we explore Rivian’s strategies, financial data, and future in the fast-evolving electric vehicle sector.

Key Points About Rivian and its Stock Performance

– Rivian Automotive, Inc. is an electric vehicle (EV) manufacturer based in the United States that is known for its creative electric trucks and SUVs.

– The business went public in November 2021, and one of the most remarkable initial public offerings (IPOs) of that year drew a lot of interest from investors.

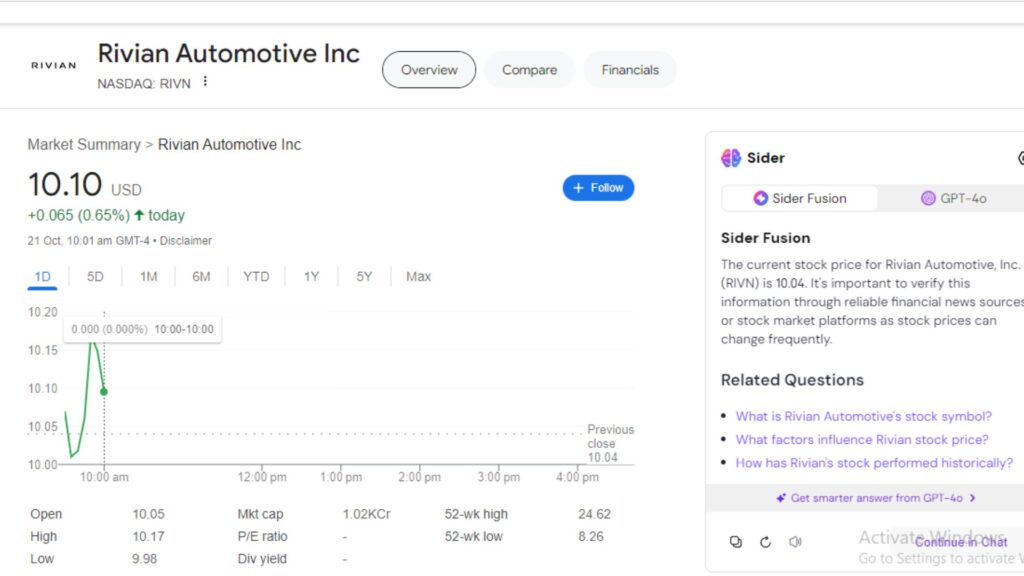

– Rivian’s stock is listed on the NASDAQ under the ticker symbol “RIVN.”

– The company has received a lot of attention because of its strong support from well-known investors like Amazon and Passage.

– Amazon, in particular, has placed a large order for 100,000 electric delivery vans from Rivian, which shows the company’s potential in the commercial vehicle market.

– Despite its promising outlook and strong demand for its vehicles, Rivian has faced challenges, including production delays and significant financial losses.

– These factors have contributed to the stock’s volatility and the mixed feelings among investors and analysts.

– Rivian’s stock performance has been marked by significant variability, a common trait in the burgeoning EV market.

– As of the latest trading sessions, Rivian’s shares have struggled, dropping to $9.50, a stark reflection of the tough competitive environment and investor sentiments.

Over the Past Year

Rivian’s stock has generally trended downward, influenced by broader economic concerns such as inflation and interest rate hikes, which have tempered investor enthusiasm in high-growth sectors like electric vehicles.

Despite these challenges, Rivian has had moments of recovery, driven by positive news such as expansions in production capacity or strategic partnerships, which temporarily buoyed the stock.

– However, these gains were often short-lived, as the underlying economic conditions and stiff competition from established automotive giants continued to exert pressure.

– The fluctuating stock price is a testament to the volatile nature of the EV industry and Rivian’s position within it—a company with potential, yet facing immense hurdles and high market expectations.

– Rivian’s financial journey reveals a blend of ambitious growth and the inherent challenges of scaling up in the competitive electric vehicle industry.

– The company’s revenue has shown impressive growth, increasing from $55 million in 2019 to an expected $4.93 billion in 2024, marking a significant leap forward in terms of production and sales.

– However, profitability remains elusive for Rivian, as is common with many startups in the EV space.

– The company reported losses, with a recent figure showing an EPS (earnings per share) loss of $4.11 this year, an improvement from previous years but still a substantial deficit.

Out of 22 Analysts Covering the Stock

There is a mix of strong buy, buy, and hold positions, suggesting a varied perception of the company’s future performance.

– Price targets for Rivian stock have a broad range, indicating differing levels of confidence in the company’s future financial health and market position.

– The average 12-month price target among analysts is $18.23, with a low estimate of $9.00 and a high estimate reaching up to $36.00.

– This wide range suggests that while some analysts see substantial upside potential, others remain wary of the risks associated with Rivian’s aggressive expansion and the competitive landscape.

– As Rivian navigates the complexities of the electric vehicle market, its future outlook hinges on several key factors including production scalability, market expansion, and technological innovation.

– Analysts predict a promising future if Rivian can maintain its production targets and continue to innovate in the electric pickup and SUV segments.

– For 2024, revenue forecasts are optimistic, expecting an increase to $7.63 billion, which would mark there was a problem generating a response. Please try again later.

Rivian’s Market Position And Recent Developments

Establishing a Foothold in the EV Market

FintechZoom Rivian Stock: Rivian has quickly positioned itself as a key player in the EV sector, competing with industry giants like Tesla and Ford. Initially focused on sustainable transportation, Rivian shifted its emphasis to electric trucks and SUVs, tapping into a lucrative market.

The R1T truck and R1S SUV have set new standards for electric vehicles, attracting adventure seekers and environmentally conscious buyers.

Financial Growth and Market Trends

Since its IPO in November 2021, Rivian has experienced notable fluctuations in stock performance, reflecting broader market trends.

Recent financial reports indicate a significant revenue increase, soaring from $663 million in Q4 2022 to $1.3 billion in Q4 2023. This impressive growth signals robust market demand and operational enhancements.

Strategic Partnerships and Expansion

Rivian’s success is bolstered by strategic partnerships, including a collaboration with Amazon for electric delivery vans.

This partnership not only diversifies Rivian’s revenue streams but also positions it favorably in the commercial vehicle market. As Rivian scales production, these alliances provide essential support for overcoming industry challenges.

Overcoming Challenges

Despite its successes, Rivian faces production delays and supply chain issues common in the automotive industry. The company has implemented strategic layoffs and cost-cutting measures to enhance profitability.

As Rivian prepares for upcoming earnings reports and product expansions, its ability to navigate operational hurdles will be critical to its success.

Financial Performance And Earnings Reports

Analyzing Recent Earnings

Rivian’s latest earnings report highlighted a remarkable revenue rise, surpassing Wall Street expectations. This growth demonstrates Rivian’s ability to scale effectively amid changing economic conditions.

Investors should closely monitor the implications of recent operational changes on Rivian’s financial stability.

Impact of Operational Changes

Rivian has enacted layoffs and cost reductions in response to economic pressures to strengthen its financial footing. Upcoming quarterly earnings will reveal how these adjustments influence the company’s fiscal health and operational efficiency.

Forward-Looking Statements

Management expressed optimism during the latest earnings call, citing strong pre-orders and advancements in manufacturing efficiency.

These forward-looking insights are essential for investors, showcasing Rivian’s strategic direction and growth potential.

Investor Expectations and Market Reaction

The market’s response to Rivian’s financial updates has been mixed, reflecting volatility in the tech and EV sectors.

However, consistent revenue growth and proactive management strategies continue to attract investor interest, particularly with the forthcoming earnings release.

Production And Delivery Milestones

Setting New Records in Production

In 2023, FintechZoom Rivian Stock achieved a production milestone by manufacturing over 39,000 electric vehicles, nearly tripling its output from the previous year. This growth is essential for maintaining competitiveness in the evolving EV landscape.

Achieving Delivery Goals

FintechZoom Rivian Stock also reported delivering over 36,000 vehicles in 2023, showcasing strong consumer demand. Meeting delivery targets is crucial for building customer trust and enhancing the brand’s reputation.

Future Production Ambitions

Looking ahead, Rivian aims to produce 52,000 vehicles in 2023, aligning with strategic expansions at its manufacturing facilities. Achieving these targets is vital for solidifying Rivian’s market position.

Overcoming Production Challenges

Rivian faces ongoing challenges, including supply chain disruptions and production delays. However, proactive measures like diversifying suppliers are crucial for maintaining production pace and fulfilling delivery commitments.

Technological Innovations And Product Enhancements

Advancements in Vehicle Technology

Rivian continues to innovate, introducing advanced technology in its vehicles. The latest software updates enhance functionalities, especially for off-road models like the R1T and R1S, improving user experience and performance.

Enhancing User Interface and Connectivity

Recent updates include a new rearview mirror with high-definition cameras, enhancing safety and visibility. Rivian’s commitment to user-friendly interfaces ensures a seamless experience for drivers and passengers alike.

Commitment to Continuous Improvement

Rivian actively seeks customer feedback to refine existing models and develop future vehicles. This continuous improvement strategy is vital for enhancing vehicle reliability and customer satisfaction.

Future Technologies in the Pipeline

Rivian plans to introduce new technologies focused on battery efficiency and autonomous driving features. These innovations are critical for improving range and reducing charging times, appealing to eco-conscious consumers.

Market Growth And Expansion Strategies

Capitalizing on Market Opportunities

Rivian strategically targets regions with strong environmental policies, such as California, to drive EV adoption. Its success in these markets serves as a model for further expansion.

Strategic Market Expansion

To broaden its reach, Rivian diversifies its product offerings and targets the commercial sector, exemplified by its partnership with Amazon. This approach mitigates risks and enhances growth prospects.

Building Brand Presence

Rivian invests in marketing to strengthen its brand presence, attending high-profile events and utilizing social media to engage with potential customers. A strong brand identity fosters customer loyalty and attracts new buyers.

Partnerships and Collaborations

Strategic partnerships are key to Rivian’s expansion strategy, enabling the company to stay at the forefront of technology and manufacturing advancements. Collaborations with established players enhance production capabilities and market entry.

Future Growth Avenues

Rivian is poised to explore international markets, particularly in Europe and Asia, where EV demand surges. Advancements in battery technology and autonomous driving will further bolster its competitive edge.

Analyst Ratings And Market Sentiment

Current Analyst Perspectives

Analysts generally maintain a positive outlook on Rivian, reflecting confidence in its strategic direction and innovative product lineup. These ratings significantly influence investor sentiment and stock activity.

Reviewing Market Sentiment

Its technological advancements and financial performance shape market perceptions of Rivian. While volatility is common in the sector, overall sentiment remains optimistic regarding Rivian’s growth trajectory.

The Impact of Industry Trends on Sentiment

Macroeconomic factors, including government policies and technological breakthroughs, influence the EV industry. Rivian’s position within this dynamic landscape positions it favorably for future growth.

Future Outlook Based on Analyst Insights

Experts expect Rivian to thrive through strategic innovations and market expansions. Investors should keep a close eye on analyst ratings and market sentiment for valuable insights into future performance.

Risks And Challenges

Navigating Market Volatility

Rivian faces inherent market fluctuations, influenced by factors like raw material prices and consumer demand. Adapting to these conditions is essential for sustaining operational stability.

Competitive Landscape

The EV market is fiercely competitive, requiring Rivian to innovate continually and differentiate itself. Effective marketing strategies are vital for building brand recognition and customer loyalty.

Supply Chain Complexities

Rivian relies on a complex supply chain for production, exposing it to risks from geopolitical tensions and trade disputes. Diversifying suppliers is essential for ensuring a stable supply of components.

Scaling Production Efficiently

Efficiently scaling production to meet demand poses a significant challenge. Rivian must optimize operations without compromising vehicle quality, a balance critical for sustained success.

Regulatory and Legal Hurdles

Navigating diverse regulatory environments is essential for Rivian’s global operations. Compliance is crucial to avoid costly legal challenges and protect the company’s reputation.

STEP-BY-STEP GUIDE FOR INVESTORS

- Understanding Rivian’s Financial Health: Review quarterly and annual reports to assess revenue growth and profitability.

- Analyzing Market Position: Investigate Rivian’s competitive edge and market share compared to its rivals.

- Evaluating Technological Innovations: Assess advancements in battery technology and manufacturing processes.

- Monitoring Market Sentiment: Keep track of analyst ratings and market perceptions to gauge investor confidence.

- Assessing Risk Factors: Consider market fluctuations and regulatory challenges when evaluating investment risks.

- Making an Informed Decision: Weigh all data and consult with financial advisors to align investments with your financial goals.

Conclusion

As we’ve explored the complexities surrounding Rivian and its role in the electric vehicle industry, it’s clear that “Fintechzoom Rivian Stock” presents a compelling investment opportunity, despite the inherent challenges.

Rivian’s evolution from a startup to a key player showcases its technological innovation, strategic market expansions, and financial growth.

Investors should closely monitor FintechZoom Rivian Stock progress, especially regarding upcoming financial reports and market strategies. The company’s focus on sustainability and innovative manufacturing positions it well for future success.

Whether you are an investor, analyst, or EV enthusiast, staying informed through platforms like Fintechzoom will provide valuable insights as the electric vehicle landscape continues to evolve.

FAQs: FintechZoom Rivian Stock

1. What is Rivian Automotive, Inc.?

Rivian is an electric vehicle manufacturer focused on producing sustainable transportation solutions, particularly electric trucks and SUVs.

2. Why is Rivian stock a popular investment choice?

Rivian has gained significant attention due to its innovative technology, strategic partnerships, and rapid growth in the electric vehicle market, making it an appealing option for investors.

3. How has Rivian’s stock performed recently?

Since its IPO, Rivian’s stock has experienced fluctuations in line with broader market trends. Recent earnings reports indicate strong revenue growth, suggesting positive momentum.

4. What role does Fintechzoom play in analyzing Rivian stock?

Fintechzoom provides comprehensive financial analysis, market insights, and updates on Rivian’s performance, helping investors make informed decisions.

5. What are Rivian’s future growth prospects?

Rivian aims to expand its production capacity, introduce new models, and enhance technological innovations, positioning itself well for future growth in the EV market.

6. What risks should investors consider when investing in Rivian stock?

Investors should be aware of market volatility, production challenges, supply chain complexities, and competitive pressures within the EV industry.

7. How can I stay updated on Rivian’s performance?

Following financial news platforms, subscribing to market analysis websites like Fintechzoom, and monitoring Rivian’s official announcements will keep you informed about its performance and developments.