Introduction to Lucid Stock

Fintechzoom Lucid Stock: Insights And Stock Forecast: Lucid Motors has rapidly emerged as a significant player in the electric vehicle (EV) market, capturing the attention of investors and industry analysts alike. Founded with the vision of creating high-performance, luxury electric cars, Lucid Motors aims to redefine the standards of the automotive industry.

As a result, the company’s stock, listed under the ticker symbol LCID, has become an essential subject of analysis within the financial and fintech communities.

The relevance of Fintechzoom Lucid Stock within the fintech community cannot be overstated. Fintech platforms such as FintechZoom provide invaluable tools and insights for tracking and analyzing stock performance. These platforms offer real-time data, comprehensive financial metrics, and expert analysis, making them indispensable resources for investors seeking to make informed decisions about Lucid stock.

Lucid’s journey in the EV market has been marked by several milestones, including the launch of its flagship model, the Lucid Air, which boasts impressive range, speed, and technological advancements.

The company’s commitment to innovation and sustainability has positioned it as a formidable competitor to established EV manufacturers like Tesla. Consequently, Lucid Motors’ stock has garnered significant interest from both institutional and retail investors, further underscoring the importance of fintech tools in monitoring its performance.

Key Takeaways

- Lucid Motors has showcased significant strides in its financial performance, marking a noteworthy trajectory in the electric vehicle (EV) sector.

- Revenue growth has been a focal point.

- Analyzing Lucid’s stock market performance reveals a pattern of volatility, typical of a burgeoning company in a highly competitive market.

- Market positioning remains a critical factor for Lucid Motors.

- Looking ahead, the future outlook for Lucid Motors appears promising.

Lucid Motors’ financial performance, stock market behavior, and strategic market positioning collectively paint a picture of a company on the rise. Investors and stakeholders should monitor these key aspects to gauge Lucid’s trajectory in the evolving landscape of the electric vehicle industry.

Lucid Motor’s (Overview)

Lucid Motors, an American electric vehicle (EV) manufacturer, has quickly emerged as a significant player in the rapidly evolving automotive industry. Founded in 2007 under the name Atieva, the company initially focused on creating advanced battery technology and powertrains.

In 2016, the company rebranded to Lucid Motors and shifted its focus to developing luxury electric vehicles, aiming to redefine the standards of performance, efficiency, and sustainability. Lucid Motors’ mission is to inspire the adoption of sustainable energy by creating the most captivating electric vehicles centered around the human experience.

This mission is reflected in their flagship model, the Lucid Air, which boasts impressive features such as a range of over 500 miles on a single charge, a top speed of over 200 mph, and an ultra–fast charging system. The company aims to set new benchmarks in the EV industry through continuous innovation and advanced technology.

The company’s strategic goals are clear: “to become a leader in the luxury EV market and to accelerate the global transition to sustainable energy“. Lucid Motors positions itself uniquely within the industry by offering high-performance, technologically advanced vehicles that appeal to the premium segment of the market.

This approach allows Lucid to stand out from competitors like Tesla, Rivian, and traditional automakers venturing into the EV space.

Lucid Motors’ key Competitive Advantages

One of Lucid Motors’ key competitive advantages is its in-house developed battery technology, which not only enhances vehicle performance but also ensures superior energy efficiency. Additionally, the company’s commitment to sustainability is evident in its efforts to minimize environmental impact through eco-friendly manufacturing processes and the promotion of renewable energy sources.

Lucid Motors has achieved several notable milestones, including the launch of the Lucid Air, the establishment of its state-of-the-art manufacturing facility in Casa Grande, Arizona, and its successful public offering. These milestones signify the company’s growth and its potential to shape the future of the automotive industry.

In essence, Lucid Motors combines cutting-edge technology with a strong commitment to sustainability, positioning itself as a formidable contender in the electric vehicle market. By continuing to innovate and expand its offerings, Lucid Motors is well-equipped to meet the rising demand for luxury electric vehicles and drive the transition towards a greener future.

Lucid Stock: Financial Performance

Lucid Motors has garnered significant attention in the electric vehicle (EV) market, and its financial performance reflects this growing interest. Analyzing recent financial statements reveals a comprehensive view of the company’s fiscal health and market potential.

In the latest quarter, Lucid reported a substantial increase in revenue, driven largely by the successful launch of its flagship model, the Lucid Air. The company’s revenue surged to $174 million, a significant leap from previous quarters, showcasing a robust demand for its premium electric sedans.

Profit Margins

However, present a more complex picture. Despite the impressive revenue growth, Lucid has yet to achieve profitability. The gross margin stood at –12%, indicative of high production costs and significant investments in research and development.

Negative Margin

This negative margin is not uncommon for emerging companies in the EV sector, which often prioritize market capture over immediate profits. Earnings per share (EPS) also reflected these ongoing investments, with a reported EPS of –$0.21.

While this negative figure may concern some investors, it is important to contextualize it within the broader industry trends and the company’s growth trajectory.

Lucid’s Financial Health

Evaluating Lucid’s financial health also necessitates a look at its debt levels and liquidity. The company maintains a manageable debt-to-equity ratio of 0.45, suggesting a balanced approach to leveraging external funding.

Additionally, Lucid has successfully secured substantial capital through various rounds of funding, including a notable investment from the Public Investment Fund of Saudi Arabia. These investments have bolstered Lucid’s cash reserves, providing a solid buffer to support its ambitious expansion plans and technological advancements.

Investment activities further underscore Lucid’s strategic positioning. The company has been aggressively investing in manufacturing capabilities, including the expansion of its Arizona facility, which is set to significantly increase production capacity.

These investments are critical for meeting anticipated demand and achieving long-term financial sustainability. Overall, while Lucid Motors faces the typical challenges of a young, high-growth company, its financial performance indicates a promising future in the rapidly evolving EV market.

Fintechzoom Lucid Stock Price Analysis

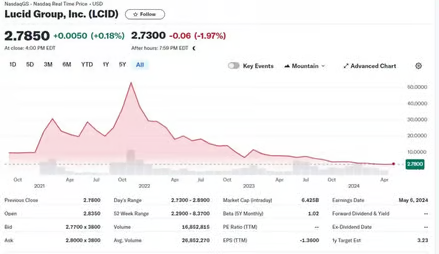

Lucid Motors’ stock price has exhibited considerable volatility since its initial public offering (IPO). Historical data reveals significant fluctuations, influenced by various market and company-specific factors. Examining these trends offers valuable insights into the stock’s performance and investor sentiment.

Since its debut, Lucid’s stock price has experienced notable peaks and troughs. For instance, following the announcement of its merger with Churchill Capital Corp IV, the stock saw a sharp increase, driven by investor excitement over the company’s potential in the burgeoning electric vehicle (EV) market.

However, this initial enthusiasm was followed by periods of decline, often coinciding with broader market corrections or delays in production milestones.

Key factors influencing Lucid’s stock price include production updates, financial performance, and market sentiment about the EV sector. Positive announcements regarding vehicle deliveries or new model launches typically result in upward stock movement.

Conversely, any delays or unfavorable quarterly results can lead to a decline. Investor confidence is also swayed by macroeconomic factors such as shifts in oil prices, changes in government policies related to EV subsidies, and technological advancements by competitors.

Technical Analysis Tools

Such as moving averages and Relative Strength Index (RSI), provide further insights into Lucid’s stock price behavior. For example, moving averages help identify trends by smoothing out price data, while RSI can indicate overbought or oversold conditions.

Charts depicting these indicators often show periods of consolidation followed by breakout or breakdown phases, reflecting shifts in market sentiment. Moreover, market sentiment analysis indicates that Lucid’s stock is highly responsive to news and social media trends.

Positive media coverage and analyst upgrades tend to bolster the stock, while negative reports or downgrades can precipitate sell-offs. Monitoring these indicators can help investors make informed decisions regarding their Lucid stock holdings.

Lucid Stock Market Positioning

Lucid Motors has strategically positioned itself within the electric vehicle (EV) market by focusing on the luxury segment, differentiating it from more mass-market competitors like Tesla and traditional automakers venturing into EVs.

This market positioning allows Lucid to target a niche yet lucrative audience that values premium features, advanced technology, and superior performance. The company’s flagship model, the Lucid Air, exemplifies this strategy with its high-end specifications, long-range capabilities, and state-of-the-art design.

In Terms of Market Share

Fintechzoom Lucid Stock is still emerging but has shown significant potential. While Tesla dominates the EV market, Lucid has carved out a space for itself by offering a distinct product that appeals to consumers looking for a combination of luxury and sustainability.

The company’s ability to capture market share will depend largely on its production capacity, delivery timelines, and customer satisfaction levels, all of which are critical factors in the highly competitive EV landscape.

Lucid’s strategic initiatives to gain a competitive edge include its focus on innovation and technology. The company has invested heavily in developing proprietary technologies, such as its advanced battery systems and electric powertrains.

These innovations not only enhance vehicle performance but also serve as a selling point for technologically savvy consumers. Additionally, Lucid’s emphasis on luxury and quality sets it apart from competitors who may prioritize affordability over premium features.

Partnerships and Collaborations

The Partnerships and collaborations play a crucial role in Lucid’s market positioning. The company has formed strategic alliances with key suppliers and technology partners to ensure the quality and reliability of its vehicles. These partnerships also enable Lucid to stay at the forefront of technological advancements, which is essential for maintaining its competitive edge.

Market expansion is another critical aspect of Lucid’s strategy. The company has outlined plans to expand its footprint beyond the United States, targeting markets in Europe, the Middle East, and Asia. This global expansion is aimed at capitalizing on the growing demand for electric vehicles worldwide and increasing its market share in the luxury EV segment.

Lucid Motors Is a Prominent Player in the EV Sector

Lucid Motors, a prominent player in the electric vehicle (EV) sector, has demonstrated a versatile approach to revenue generation. Primarily, the company’s revenue streams are concentrated on vehicle sales, which represent the lion’s share of its income.

The introduction of the Lucid Air, an all-electric luxury sedan, has been a significant contributor to this revenue stream. The vehicle’s advanced technology, superior range, and luxurious features have positioned it as a strong competitor in the high-end EV market, driving substantial sales.

Generates Revenue Through its Service Offerings

Beyond vehicle sales, Lucid Motors also generates revenue through its service offerings. These include maintenance packages, software upgrades, and other after-sales services that enhance the customer experience and extend the vehicle’s lifespan.

By adopting a customer-centric approach, Lucid has managed to create additional value for its clients, which translates into recurring revenue streams. Another critical revenue segment for Lucid Motors is derived from its strategic partnerships and technology licensing.

The company has been proactive in forging alliances with other industry players, leveraging its cutting-edge EV technologies. These collaborations not only provide additional revenue but also help Lucid in expanding its market reach and strengthening its brand presence.

Key revenue drivers for Lucid Motors include the continuous innovation in vehicle technology, the expansion of its product lineup, and the enhancement of its manufacturing capabilities. The company’s investment in research and development ensures that it remains at the forefront of EV advancements.

Future growth opportunities are also anticipated from the broader adoption of electric vehicles globally, driven by increasing environmental awareness and supportive government policies.

Industrial Position of Lucid Stock

Lucid Motors operates in an intensely competitive and rapidly evolving automotive industry, particularly within the electric vehicle (EV) sector. The industry trend toward sustainable and eco-friendly transportation solutions has gained significant momentum, driven by growing environmental awareness and stringent regulatory mandates.

Governments worldwide are implementing policies to reduce carbon emissions, which has created a favorable regulatory environment for EV manufacturers like Lucid Motors. Lucid Motors distinguishes itself through its commitment to luxury and performance in the EV market.

The company’s flagship model, the Lucid Air, boasts impressive specifications, including extended range, rapid charging capabilities, and advanced autonomous driving features. This positions Lucid as a serious contender in the premium EV segment, competing with established players like Tesla, Mercedes–Benz, and BMW.

Emerging Technologies

Emerging technologies such as autonomous driving, battery advancements, and connectivity are crucial to the industry’s future. Lucid Motors has invested heavily in R&D to innovate in these areas. Their proprietary battery technology promises higher efficiency and longer life, giving them an edge in the competitive landscape.

Additionally, the company’s focus on software and AI-driven autonomous driving systems aligns with future industry demands. When comparing Lucid Motors to its industry peers, several factors stand out. Tesla remains a dominant force in the EV market, with a well-established brand and extensive charging infrastructure.

However, Lucid’s unique value proposition of luxury and cutting-edge technology offers a different appeal. Companies like NIO and Rivian also pose significant competition, but Lucid’s focus on the high-end market segment differentiates it from these competitors.

Lucid Motors’ Long-Term Industrial Prospects Appear Promising

Given the growing demand for EVs and the company’s strategic positioning. However, the company must navigate challenges such as supply chain constraints, intense competition, and the need for continuous innovation.

If Lucid can maintain its technological edge and expand its market reach, it stands to secure a strong position within the global automotive industry. Cash flow analysis is a critical component in evaluating the financial health and growth potential of any company, and Lucid Motors is no exception.

Examining the cash flow statements of Lucid Motors provides a detailed perspective on the company’s operating, investing, and financing activities, offering valuable insights into their cash flow management and liquidity position.

Operating Activities

Lucid Motors’ cash flow from operating activities reveals the cash generated or consumed by the company’s core business operations. It encompasses net income adjusted for changes in working capital, depreciation, and other non-cash items.

Positive cash flow from operating activities indicates that Lucid Motors is generating sufficient cash from its primary business functions to sustain day-to-day operations. Conversely, negative cash flow may signal potential issues in the company’s operational efficiency or profitability.

Investing Activities

The cash flow from investing activities section highlights Lucid Motors’ expenditures on capital assets, such as property, plant, and equipment. This category also includes cash flows related to mergers, acquisitions, or the sale of assets.

Significant capital expenditures (CapEx) suggest that Lucid Motors is investing heavily in its production capabilities, research and development, or expansion initiatives. While high CapEx can initially strain liquidity, it is often necessary for long-term growth and technological advancement in the highly competitive electric vehicle market.

Financing Activities

Cash flow from financing activities encompasses transactions involving debt, equity, and dividends. This section reveals how Lucid Motors finances its operations and growth projects through the issuance of stocks, bonds, or other financial instruments.

Understanding the balance between debt and equity financing is crucial, as an over-reliance on debt can lead to increased financial risk, whereas equity financing might dilute existing shareholders’ value. Lucid Motors’ approach to financing can significantly impact its financial stability and investor confidence.

Overall, Lucid Motors’ cash flow trends provide essential insights into its financial strategies and stability. Effective cash flow management is vital for ensuring liquidity, supporting ongoing operations, and funding future growth. For investors and stakeholders, analyzing these cash flow patterns can offer a clearer picture of Lucid Motors’ financial health and its potential trajectory in the electric vehicle market.

FintechZoom Lucid Stock Symbol

Lucid Motors, a prominent player in the electric vehicle market, is represented by the stock symbol “LCID” on FintechZoom and other financial platforms. This stock symbol plays a critical role for investors and analysts as it serves as a unique identifier for Lucid Motors’ shares in the trading ecosystem.

The LCID symbol is used in various financial transactions and market analyses, allowing stakeholders to quickly reference and track the company’s stock performance. For those involved in trading, the LCID stock symbol is integral to executing buy, sell, or hold decisions.

It is prominently displayed on FintechZoom, a leading financial news and information platform, where real-time data on Lucid Motors’ stock can be accessed. The symbol simplifies the process of locating specific information about Lucid’s stock, including current price, historical performance, volume, and market capitalization.

Investors and Analysts Utilize the Stock Symbol

The Investors and analysts utilize the stock symbol LCID to analyze trends and make informed decisions. Fintechzoom Lucid Stock offers a suite of tools that enhance this analysis, such as interactive charts, financial news updates, and expert commentary. By leveraging these resources, stakeholders can gain a comprehensive understanding of Lucid Motors’ market positioning and financial health.

Tracking and analyzing Lucid’s stock on FintechZoom can be particularly beneficial. The platform provides detailed insights into market trends and potential future movements. Users can set alerts for significant price changes, monitor trading volumes, and review financial statements. These features enable a thorough analysis, ensuring that investors have the most current and relevant information at their fingertips.

In summary, the LCID stock symbol on FintechZoom is an essential tool for anyone interested in Lucid Motors. It facilitates efficient trading, in-depth analysis, and informed decision-making, thereby playing a crucial role in the financial strategies of investors and analysts alike.

FintechZoom Lucid Stock Price Prediction

Lucid Motors, a prominent player in the electric vehicle market, has garnered significant attention from investors and analysts alike. According to predictions from FintechZoom, the stock’s future performance is a topic of keen interest, driven by various forecasting models and expert opinions.

This section will delve into these predictions, offering a comprehensive view of both short-term and long-term price targets, while also considering the catalysts and risks that could influence Lucid’s stock trajectory.

In the Short Term

FintechZoom’s analysts suggest that Lucid Motors’ stock price may experience volatility due to market sentiment and external factors such as regulatory changes and technological advancements within the EV sector.

The consensus among experts indicates a price target in the range of $30 to $35 per share over the next six months, contingent on successful delivery milestones and favorable quarterly financial results. This projection is supported by recent data showing an upward trend in Lucid’s production capabilities and increasing demand for their luxury electric vehicles.

In the Long-Term

Looking at the long-term perspective, FintechZoom’s models predict a more optimistic outlook for Lucid Motors, with potential price targets reaching $50 to $60 per share within the next two to three years. This forecast is based on assumptions of continued growth in the electric vehicle market, successful expansion into international markets, and sustained innovation in battery technology and autonomous driving features.

Additionally, strategic partnerships and potential government incentives for clean energy vehicles are considered significant catalysts that could propel Lucid’s stock upward.

However, it is crucial to acknowledge the inherent risks associated with these predictions. Factors such as supply chain disruptions, increased competition from established and emerging EV manufacturers, and potential delays in product rollouts could adversely impact Lucid’s stock performance.

Moreover, broader economic conditions and investor sentiment towards high-growth technology stocks will continue to play a pivotal role in shaping Lucid’s market position.

While FintechZoom’s analyses project a promising future for Lucid Motors’ stock, it remains essential for investors to stay informed about ongoing developments and market dynamics. A balanced approach, considering both potential rewards and risks, will be key to making informed investment decisions.

FintechZoom Lucid Stock Forecast

Lucid Motors has captured significant attention in the electric vehicle (EV) market, prompting numerous financial forecasts and analyses. According to FintechZoom, the outlook for Lucid’s stock is influenced by several key factors, including market trends, economic indicators, and company-specific developments. Understanding these elements can provide a comprehensive picture of potential growth scenarios and downside risks.

Market trends play a pivotal role in shaping Lucid’s stock performance. The increasing adoption of electric vehicles worldwide, driven by both consumer demand and regulatory initiatives, positions Lucid favorably in a growing market.

However, competition from established automakers and new entrants alike adds a layer of complexity. Lucid’s ability to differentiate itself through luxury and performance could be a significant advantage if executed effectively.

Economic Indicators also Weigh Heavily on Stock Forecasts

Inflation rates, interest rates, and overall economic growth can impact consumer spending and investment in high-value items like luxury electric vehicles. Analysts from FintechZoom suggest that a stable economic environment would support Lucid’s ambitious expansion plans, while economic downturns could pose challenges to its market positioning and financial performance.

Company-specific factors are perhaps the most critical in forecasting Fintechzoom Lucid Stock trajectory. The successful rollout of new models, production ramp-up, and technological innovations are essential for maintaining investor confidence. Lucid’s recent achievements, such as the launch of the Lucid Air and plans for future models, are promising signs. However, any production delays or technological setbacks could negatively impact stock performance.

The website provides information on market trends, Lucid stock performance, and projections for the company’s future prospects. The stock has seen significant momentum as Lucid Motors has made progress with products such as the Lucid Air and Lucid Gravity SUV, with strategic financial backing from Saudi Arabia in particular. The stock price of Lucid Motors was $2.3600 as of April 2024, falling within a 52-week range of $2.2900–$8.3700.

In summary, the FintechZoom forecast for Lucid Motors’ stock is cautiously optimistic. The company’s market positioning, economic context, and specific operational factors will be pivotal in determining its financial trajectory. Investors are advised to consider these multifaceted elements when evaluating Lucid’s stock potential.

Lucid Group Stock Forecast 2030

As we project Lucid Motors’ stock performance up to the year 2030, several key factors come into play, including future growth prospects, technological advancements, and market expansion opportunities. These elements will be pivotal in shaping Lucid’s trajectory in the coming years.

Firstly, Lucid Motors is poised to leverage its innovative technological advancements in the electric vehicle (EV) sector. The company’s emphasis on high–performance, luxury EVs sets it apart from many competitors.

Their flagship model, the Lucid Air, with its impressive range and advanced features, demonstrates the company’s ability to push the boundaries of electric mobility. Continuous investment in research and development is expected to yield more cutting-edge technologies, further solidifying Lucid’s position in the market.

Market Expansion is Another Critical Factor

Lucid Motors is not just focused on the U.S. market; it is also eyeing international markets, particularly in Europe and Asia. These regions have shown substantial growth in EV adoption, supported by favorable regulatory policies and increasing consumer demand for sustainable transportation solutions.

By establishing strategic partnerships and expanding its sales network, Lucid can tap into these lucrative markets and drive significant revenue growth over the next decade.

2030 Stock Forecast. If Lucid Group, Inc.’s stock continues to increase at its current 10-year average rate, it will hit $16.80 in 2030. The stock of Lucid Group, Inc. (LCID) will increase 515.40% from its current price if the 2030 forecast for the company comes true.

Economic factors, including fluctuating raw material prices and varying government incentives, will also play a crucial role. Investors should remain vigilant about these uncertainties as they can affect profitability and, consequently, stock performance. Despite these challenges, Lucid Motors’ strong commitment to innovation and market expansion positions it well for substantial growth by 2030.

Conclusion

In summary, Lucid Motors has demonstrated notable advancements in both its financial performance and market positioning. The company’s innovative approach to electric vehicle (EV) technology and its commitment to sustainability have helped it carve out a distinct niche in a highly competitive market. Financially, Lucid has shown promising growth metrics, with increasing revenues and strategic investments that bolster its long-term viability.

However, like any emerging company in a rapidly evolving industry, Lucid Motors faces challenges. Market volatility, regulatory changes, and competitive pressures are factors that can impact its stock performance. Therefore, diligent monitoring of the company’s financial health and market trends is crucial for investors. Utilizing fintech platforms such as FintechZoom can provide valuable insights and real-time data, aiding in making well-informed investment decisions.

Looking ahead, Lucid’s prospects seem optimistic, supported by its robust technology pipeline and strategic market positioning. Investors should remain vigilant and stay informed through reliable sources to navigate the complexities of the stock market effectively. Continuous evaluation of Lucid’s performance, alongside broader industry trends, will be essential in assessing the future trajectory of its stock value.

Ultimately, while Lucid Motors presents significant opportunities, it is essential to approach investments with a balanced perspective, considering both potential rewards and inherent risks. By leveraging comprehensive analysis and utilizing advanced fintech tools, investors can better position themselves to capitalize on the evolving landscape of the EV market.

Frequently Asked Questions

How high is Lucid stock expected to go?

The average 12-month price objective for Lucid Group shares, as estimated by nine analysts, is 3.82; low and high estimates are 2.90 and 5.00, respectively. The average target suggests that the stock price, which is currently 2.85, will rise by 34.04%.

What is Lucid stock prediction for 2025?

Forecast for Lucid Group, Inc.’s stock price in a year: $ 22.39 (702.52%) Forecast for Lucid Group, Inc.’s stock in 2025: $3.78 (35.37%)

Who owns the most LCID stock?

The largest shareholder in Lucid Group (LCID) is Mohammed bin Salman Al-Saud.

How many stocks does Lucid have?

The corporation has 2,301,870,644 outstanding shares at the end of 2024. Stock splits and buybacks of shares typically have an effect on the number of outstanding shares.

What Elon Musk says about Lucid?

Musk said earlier this year that the only reason Lucid is still around is because “Their Saudi sugar daddy is the only thing keeping them alive.”