FintechZoom Intel Stock: Understanding the stock market is crucial for savvy investors in today’s fast-paced financial landscape. One stock that has garnered significant attention is Intel Corporation (NASDAQ: INTC).

As a leader in the semiconductor industry, Intel’s performance can heavily impact the tech sector and provide valuable insights for investors.

In this article, we will dive into the fundamentals of Intel stock, analyze its financial performance, explore market trends, and discuss the future outlook, all while referencing insights from FintechZoom.

Understanding Intel Corporation

A Brief History

Founded in 1968, Intel Corporation has been at the forefront of technological advancements, especially in semiconductors. Initially famed for its microprocessors, Intel’s innovations have shaped the computing landscape.

Key Products and Services

Intel’s product line includes microprocessors, memory chips, and integrated graphics. Their most popular offerings include the Intel Core processors, Xeon processors for servers, and a range of chipsets that support various tech applications.

Major Milestones

Intel’s journey is marked by groundbreaking advancements, such as the invention of the x86 architecture and the introduction of the Pentium brand. Over the decades, Intel has continually adapted to market demands, including its recent push into AI-driven technologies.

Market Position

Today, Intel stands as one of the leading semiconductor companies, competing with names like AMD and NVIDIA. As of 2023, Intel holds a significant share of the global market, reinforcing its reputation as an industry titan.

The Importance of Intel Stock

When considering a technology investment, Intel stock is a pivotal option for many investors. Its strong historical performance and innovation track record position it as a potential reliable investment.

Historical Performance

Since its IPO, Intel’s stock price has experienced significant fluctuations. Over the last decade, the stock has provided substantial returns, though recent years have seen increased competition raise questions about its growth trajectory.

Peer Comparison

When comparing with peers, Intel’s performance often contrasts with AMD and NVIDIA, which have captured market share through aggressive marketing and innovative product launches. This competition adds complexity to Intel’s stock outlook.

Current Market Analysis

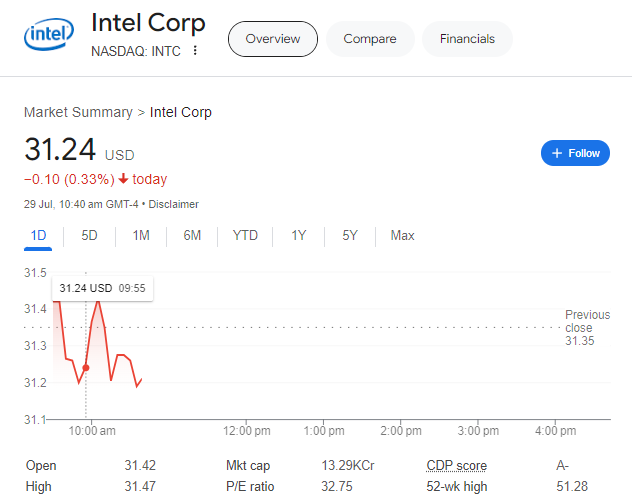

INTC – Intel Corporation

| Market cap | 133.453B |

|---|---|

| PE ratio (TTM) | 32.32 |

| EPS (TTM) | 0.97 |

| Earnings date | 01 Aug 2024 |

| Forward dividend & yield | 0.50 (1.59%) |

As of 29/July/2024, Intel’s stock price is approximately 31.24 USD. 𝑇ℎ𝑒 𝑐𝑜𝑚𝑝𝑎𝑛𝑦′𝑠 𝑚𝑎𝑟𝑘𝑒𝑡 𝑐𝑎𝑝𝑖𝑡𝑎𝑙𝑖𝑧𝑎𝑡𝑖𝑜𝑛 𝑠𝑡𝑎𝑛𝑑𝑠 𝑎𝑡 𝑎𝑟𝑜𝑢𝑛𝑑 32.32 USD. The company′s market capitalization stands around $133.45 billion, making it a significant player in the tech sector.

Recent Trends

Recent trends indicate a volatile stock price amid global supply chain challenges and competition from rivals. Its stock has seen ups and downs, reflecting investor sentiment and market conditions.

Dividend History

Intel has a robust dividend history, with a current dividend yield of approximately 1.60% (annually). The consistency of dividend payments has made Intel attractive to income-seeking investors.

Financial Performance Analysis

| Intel Corporation Consolidated Condensed Statements of Income and Other Information | ||

|---|---|---|

| Three Months Ended | ||

| Net revenue | $ 12,724 | $ 11,715 |

| Cost of sales | 7,507 | 7,707 |

| Gross margin | 5,217 | 4,008 |

Key Financial Metrics

Key metrics like profit margins and cash flow are integral for investors. Intel’s profit margin stands at approximately 1.2KCr. Additionally, its cash flow from operations indicates, check cash flow insights.

Growth Potential

While Intel faces challenges such as delayed product releases and increasing competition, its investment in R&D showcases a commitment to innovation, suggesting potential for future growth.

Market Trends Influencing Intel Stock

The semiconductor industry is evolving, with AI and machine learning becoming pivotal. Intel’s strategic initiatives in these areas may provide avenues for growth, considering the increasing demand for high-performance computing.

Geopolitical Risks

Geopolitical tensions and supply chain disruptions, particularly stemming from COVID-19, continue to pose risks. Intel’s ability to navigate these challenges will be vital for maintaining stock stability.

Analysts’ Opinions and Recommendations

Recent ratings from analysts show a mixed sentiment towards Intel stock. According to FintechZoom, the average target price among analysts is around $38.02, indicating a potential upside from its current price.

Expert Opinions

Analysts express varying opinions based on recent performance and competitive standing. While some remain bullish based on Intel’s long-term strategy, others remain cautious due to market dynamics and competition.

Risks in Investing in Intel Stock

Investing in Intel carries inherent risks, including market volatility and competitive pressure. The tech sector is known for rapid changes, which can affect stock performance significantly.

Historical Volatility Analysis

Historically, Intel stock has experienced significant fluctuations, with periods of both strong growth and sharp declines. Understanding these patterns can aid investors in making informed decisions.

Future Outlook for Intel Stock

Experts predict that Intel’s stock may experience fluctuations but could trend upward if the company capitalizes on emerging technologies and manages its R&D effectively.

Growth Catalysts

Key catalysts such as the release of new products and strategic partnerships could enhance Intel’s growth trajectory. The company’s focus on AI and data centers may also pay dividends in the long run.

How to Invest in Intel Stock

Investors can buy Intel stock through various platforms—traditional brokerage firms, online trading platforms, or ETFs that focus on the tech sector.

Tips for New Investors

New investors should consider diversifying their portfolios and staying informed through reputable financial news sources like FintechZoom to make educated investment choices.

Conclusion

Intel Corporation remains a compelling option for investors looking to delve into the tech sector. While the stock presents both opportunities and risks, understanding its fundamentals can guide potential investors in making informed decisions.

As always, remaining updated with market trends and insights will help maximize investment potential.

Additional Resources and References

- Intel Corporation Investor Relations: Intel Investor Relations

- FintechZoom: FintechZoom Homepage

What are your thoughts on Intel stock? Share your insights in the comments below! For more expert analyses and updates, subscribe to our newsletter.

FAQs: FintechZoom Intel Stock

1. What is Intel Corporation?

Intel Corporation is a multinational technology company known primarily for its semiconductor manufacturing. It designs and produces a range of products including microprocessors, integrated circuits, and other hardware components used in computers and data centers.

2. How has Intel’s stock performed historically?

Historically, Intel’s stock has experienced significant fluctuations. Over the past decade, it has provided substantial returns, but in recent years, the stock has faced challenges from increased competition and market dynamics.

3. Is Intel stock a good investment?

Whether Intel stock is a good investment depends on individual financial goals, risk tolerance, and market analysis. It has a history of dividend payments and growth potential, but investors should consider the company’s competitive challenges and market conditions.

4. What are the key risks of investing in Intel?

Key risks include market volatility, competition from companies like AMD and NVIDIA, geopolitical tensions, and supply chain risks. Understanding these factors is essential for assessing investment risk.

5. Does Intel pay dividends?

Yes, Intel has a historically strong dividend policy, with a current dividend yield of approximately [insert yield]. Dividends can provide a steady income stream for investors.

6. How does Intel compare to its competitors?

Intel competes with other semiconductor giants like AMD and NVIDIA. While Intel has a significant market presence, competitors have gained market share through innovative products and aggressive pricing strategies.

7. What should new investors know before investing in Intel?

New investors should conduct thorough research, understand market trends, and consider diversifying their portfolios. Consulting financial news sources and seeking advice from financial advisors is also recommended.

8. What are the future growth prospects for Intel?

Future growth prospects for Intel may depend on its ability to innovate and release new products, particularly in the AI and data centers sector. Observing industry trends and Intel’s strategic initiatives will provide better insight into its growth potential.