In today’s rapidly evolving business landscape, managing customer relationships effectively is paramount for success. Fintechzoom CRM stock represents a powerful tool for businesses seeking to enhance their customer engagement, streamline marketing efforts, and leverage data analytics.

As more companies turn to cloud-based solutions, understanding the nuances of CRM’s stock performance has become essential for investors and industry analysts alike.

In this comprehensive article, we will delve into the recent performance of CRM’s stock, analyze its financial health, explore market predictions, and assess future growth opportunities. This detailed analysis aims to provide potential investors with valuable insights to make informed decisions.

The Importance of CRM in the Tech Industry

Customer Relationship Management (CRM) systems are vital for businesses of all sizes. They enable organizations to manage interactions with current and potential customers, improve customer satisfaction, and drive sales growth. As the digital landscape continues to expand, the demand for sophisticated CRM solutions has surged.

CRM’s ability to integrate with various business functions, such as sales, marketing, and customer service, makes it a critical component in the toolkit of modern enterprises.

This integration is essential not only for maintaining customer loyalty but also for gaining a competitive edge in crowded markets.

Recent Performance of Fintechzoom CRM Stock

Stock Performance Overview

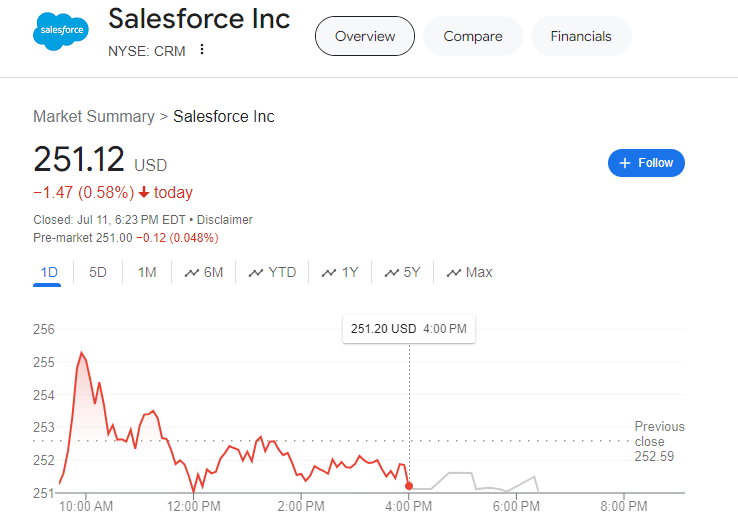

In the past year, CRM has demonstrated considerable resilience in the stock market. The stock has experienced fluctuations, largely driven by external market conditions and internal company developments.

Recently, analysts have projected that CRM stock could experience significant gains, with price estimates ranging from $153 to $365.

Factors Influencing Stock Movements

Market Sentiment: The overall market sentiment significantly impacts stock prices. In times of uncertainty, investors often become cautious, leading to volatility.

However, CRM’s innovative approach and strategic initiatives have helped maintain investor confidence even during challenging periods.

Company Developments: Key announcements regarding product launches, partnerships, or technological advancements can sway stock prices.

For instance, CRM’s continued investment in artificial intelligence and cloud technology has been well-received by investors, contributing to upward momentum.

Earnings Reports: Regular earnings releases provide critical insights into a company’s financial health. Positive earnings results often correlate with stock price increases, while disappointing reports can lead to declines.

Financial Analysis of Fintechzoom CRM Stock

Revenue Growth

The financial performance of CRM is a key metric for evaluating its stock value. Over the past fiscal year, CRM reported an impressive $38.36 billion in revenue, marking a significant increase compared to previous years.

This growth reflects the company’s ability to attract and retain customers in a highly competitive market.

Earnings Per Share (EPS)

One of the most telling indicators of a company’s financial health is its earnings per share (EPS). CRM has seen its EPS rise from $4.20 to $9.86 in the past year, representing a remarkable 134.74% increase.

This significant growth is attributed to effective cost management and operational efficiency, both of which are critical for long-term success.

Profit Margins

CRM’s profit margins are another area of strength. The company’s focus on streamlining operations and enhancing productivity has allowed it to improve its bottom line.

Higher profit margins indicate that CRM is not only generating more revenue but also managing expenses effectively.

Future Projections for Fintechzoom CRM Stock

Revenue and Earnings Forecasts

Looking ahead, CRM anticipates continued growth. The company projects revenue to reach $42.40 billion in the upcoming fiscal year, which translates to a 10.51% increase.

This optimistic forecast is driven by strategic initiatives aimed at expanding cloud services and integrating advanced artificial intelligence capabilities.

Analysts’ Predictions

Market analysts are bullish on CRM’s future performance. The average target price for CRM stock is currently around $310.61, with projections varying between $153 and $365. This range reflects a consensus that the stock has significant upside potential.

Investment Sentiment

The prevailing sentiment among investment analysts is largely positive, with a majority of ratings categorized as “Buy” or “Strong Buy.”

This optimism stems from CRM’s robust financials, innovative product offerings, and proactive management strategies that position the company well in the evolving tech landscape.

Ratings and Expert Opinions on Fintechzoom CRM Stock

Analyst Recommendations

Analysts from leading financial institutions have expressed confidence in CRM’s stock, recommending it as a solid investment option.

Firms such as Jefferies and Wolfe Research have recently revised their price targets upward, anticipating that CRM will continue to perform well in the coming quarters.

- Jefferies: Price target increased to $350.

- Wolfe Research: Price target increased to $365.

These upward revisions highlight analysts’ belief in CRM’s ability to navigate market challenges and capitalize on growth opportunities.

Comparative Analysis

When comparing CRM to its competitors, it becomes evident that CRM stands out in terms of innovation and market adaptability.

Many competitors are struggling to keep pace with the rapid advancements in technology, whereas CRM has consistently introduced new features and enhancements that meet customer demands.

The Role of Innovation in Fintechzoom CRM Stock

Cloud Technology and AI Integration

CRM’s strategic focus on cloud technology and artificial intelligence has positioned it as a leader in the industry. The increasing demand for cloud-based solutions has created a fertile ground for CRM’s growth.

By continuously enhancing its product offerings and incorporating AI-driven features, CRM is meeting the evolving needs of its customer base.

Customer-Centric Approach

CRM’s dedication to understanding and addressing customer needs is evident in its product development strategies.

The company actively solicits feedback from users to inform future enhancements, ensuring that its offerings remain relevant and effective. This customer-centric approach not only fosters loyalty but also attracts new clients.

Risks and Challenges for Fintechzoom CRM Stock

Market Competition

While CRM has established itself as a leader, the competitive landscape remains intense. Numerous companies are vying for market share in the CRM space, and as technology evolves, new entrants could pose significant threats. CRM must continue to innovate to stay ahead of competitors.

Economic Factors

Global economic conditions can impact CRM’s stock performance. Economic downturns or shifts in consumer spending patterns may affect revenue growth. Investors should remain vigilant about macroeconomic trends influencing CRM’s business model.

Regulatory Changes

As a tech company, CRM is subject to various regulations that can affect its operations. Changes in data privacy laws, for instance, could have implications for how CRM handles customer data.

Adapting to regulatory changes will be crucial for maintaining compliance and safeguarding the company’s reputation.

Strategies for Investors in Fintechzoom CRM Stock

Long-Term Investment Perspective

For investors considering CRM stock, a long-term perspective is advisable. While short-term fluctuations may occur, the company’s solid fundamentals and growth potential make it an attractive option for those willing to hold their investment over time.

Diversification

Investors should also consider diversification when adding CRM stock to their portfolio. Balancing investments across various sectors can help mitigate risks associated with market volatility. A well-rounded portfolio with growth and value stocks can enhance overall returns.

Monitoring Key Indicators

Staying informed about CRM’s performance and the overall market landscape is essential for investors. Regularly reviewing earnings reports, analyst recommendations, and industry trends will provide valuable insights into when to buy, hold, or sell shares.

Conclusion

In summary, Fintechzoom CRM stock presents a compelling investment opportunity for those looking to capitalize on the growth of cloud-based customer relationship management solutions.

With impressive revenue growth, a strong financial outlook, and positive market sentiment, CRM is well-positioned for the future.

As the demand for innovative CRM solutions continues to rise, CRM’s strategic AI and cloud technology initiatives will likely drive its success. While challenges exist, the company’s commitment to innovation and customer satisfaction makes it a strong contender in the tech industry.

Investors should consider CRM stock as part of a diversified investment strategy, keeping an eye on market trends and company developments to maximize their returns.

By understanding the intricacies of CRM’s performance and the broader market landscape, investors can make informed decisions that align with their financial goals.

FAQs: Fintechzoom CRM Stock

1. What is Fintechzoom CRM?

Fintechzoom CRM is a cloud-based customer relationship management solution that helps businesses manage customer interactions, automate marketing efforts, and analyze data to improve sales and customer satisfaction.

2. How has Fintechzoom CRM stock performed recently?

Recently, Fintechzoom CRM stock has shown resilience in the market, with price projections ranging from $153 to $365. The stock has experienced fluctuations due to market conditions and company developments, but overall sentiment remains positive.

3. What factors influence the stock price of Fintechzoom CRM?

Several factors influence Fintechzoom CRM stock prices, including market sentiment, company earnings reports, strategic initiatives (like advancements in AI and cloud technology), and overall economic conditions.

4. What are the financial highlights of Fintechzoom CRM?

In the last fiscal year, Fintechzoom CRM reported revenues of $38.36 billion and earnings per share (EPS) increased from $4.20 to $9.86, reflecting strong growth and effective cost management.

5. What do analysts say about Fintechzoom CRM stock?

Analysts generally hold a positive outlook on Fintechzoom CRM stock, with many giving it a “Buy” rating. Price targets have been raised by firms like Jefferies and Wolfe Research, indicating confidence in the company’s growth prospects.

6. What are the growth projections for Fintechzoom CRM?

Fintechzoom CRM is expected to generate revenues of $42.40 billion in the upcoming fiscal year, reflecting a growth rate of 10.51%. Analysts anticipate continued success due to the company’s strategic focus on cloud services and AI integration.

7. What risks should investors consider?

Investors should be aware of potential risks such as intense market competition, economic downturns, and regulatory changes that could impact CRM’s operations and stock performance.

8. Is Fintechzoom CRM a good long-term investment?

Many analysts believe that Fintechzoom CRM represents a solid long-term investment opportunity due to its strong financial performance, innovative products, and positive market sentiment. However, investors should consider their own financial goals and risk tolerance.