Fintechzoom Best Insurance: Navigating the insurance landscape can be daunting, but having a reliable resource can make all the difference. Fintechzoom has emerged as a premier platform to simplify insurance selection.

This innovative tool provides a straightforward way for users to compare rates, terms, and coverage options. Whether you need extensive health insurance, crucial auto coverage, or comprehensive home and life policies, Fintechzoom offers tailored solutions.

This guide explores the features that make Fintechzoom a top choice for superior insurance solutions, helping you confidently make informed decisions.

Fintechzoom’s Innovative Approach to Insurance

Streamlining the Insurance Purchasing Process

Fintechzoom has redefined how people purchase insurance by merging cutting-edge technology with a user-centric approach.

Unlike traditional insurance methods that often involve complex jargon, Fintechzoom simplifies the process with clear, accessible language.

This clarity helps users understand their insurance choices better, fostering confidence and trust in their decisions.

Educating Users with Detailed Insights

A major component of Fintechzoom’s approach is its focus on user education. The platform offers comprehensive information about various insurance policies, highlighting important differences and their impact.

Users can access detailed explanations of policy exclusions, benefits, and fine print. Fintechzoom also provides tools to visualize how different choices affect coverage and costs over time, aiding in more precise financial planning.

Prioritizing Customer Needs

Fintechzoom’s commitment goes beyond offering comparison tools. The platform adapts to individual preferences, catering to tech-savvy users and those who prefer more traditional methods.

By actively incorporating user feedback, Fintechzoom continually improves its offerings, demonstrating a strong commitment to meeting and exceeding customer expectations.

Key Features of Fintechzoom’s Insurance Platform

Intuitive User Interface

Fintechzoom’s platform is designed to be user-friendly, accommodating all levels of technical proficiency. Its clean, straightforward design ensures easy navigation, making it accessible for new and experienced users alike.

Features like drop-down menus, interactive guides, and predictive text simplify the insurance selection process.

Commitment to Transparency

Transparency is a fundamental principle at Fintechzoom. The platform provides a clear breakdown of costs, benefits, and coverage limitations, avoiding the hidden fees and obscure terms common in traditional insurance policies.

Visual aids such as graphs and charts help users understand how premiums vary, enabling them to make informed decisions.

Real-Time Comparisons and Customizations

One of Fintechzoom’s standout features is its real-time policy comparison tool. Users can input their details and preferences to quickly compare different insurance options. This feature evaluates premiums, coverage levels, and deductibles.

Fintechzoom also allows for policy customization, letting users adjust their coverage and see how changes affect premiums and terms.

Educational Resources and Support

Fintechzoom is dedicated to educating its users. The platform offers a wealth of resources, including articles, FAQs, and video tutorials that clarify insurance concepts and provide purchasing tips.

Customer support is available through phone, email, and live chat, offering personalized advice and technical assistance.

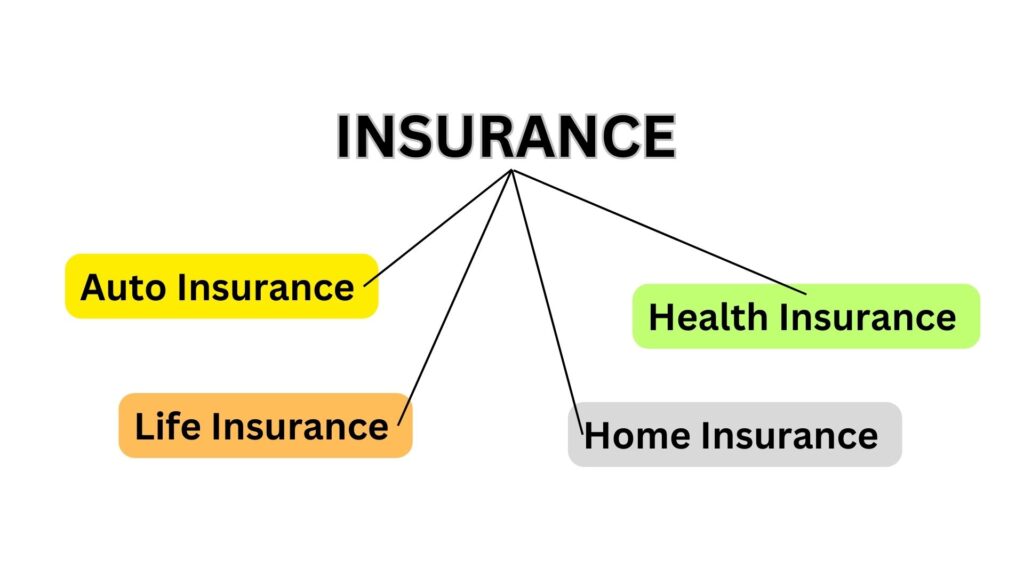

Insurance Options Available Through Fintechzoom

Auto Insurance

- Coverage Options: Fintechzoom offers a variety of auto insurance coverages, including liability, collision, comprehensive, and personal injury protection. Each type of coverage is clearly explained to help users understand what is covered.

- Customizable Deductibles: Users can adjust their deductibles to balance premium costs and coverage based on their budget. The platform provides instant updates on how these changes impact policy costs.

- Special Discounts: Fintechzoom partners with car manufacturers and safety organizations to offer discounts for advanced safety features and safe driving records.

Home Insurance

- Coverage for Various Property Types: Fintechzoom provides insurance for houses, condominiums, and rental properties, covering structures, personal belongings, and liability.

- Additional Coverage Options: Users can opt for extra coverage for floods, earthquakes, and high-value items like jewelry and art, which may not be included in standard policies.

- Interactive Tools: The platform includes tools to calculate the value of homes and possessions, ensuring adequate coverage and preventing underinsurance.

Health Insurance

- Range of Plans: Fintechzoom offers various health insurance plans, including individual, family, and group options. This includes HMOs, PPOs, and HSAs, allowing users to choose a plan that fits their healthcare needs and budget.

- Transparent Comparisons: Users can compare different health plans based on premiums, out-of-pocket costs, provider networks, and covered services.

- HSA Benefits: For eligible plans, Health Savings Accounts (HSAs) provide tax advantages and can be used for qualified medical expenses, helping manage healthcare costs effectively.

Life Insurance

- Customizable Policies: Users can select between term life insurance with adjustable terms and coverage amounts or whole life insurance with lifelong coverage and a cash value component.

- Needs Analysis Tools: The platform offers tools to help users assess their financial obligations and resources, determining the appropriate life insurance coverage.

- Educational Materials: Fintechzoom provides extensive resources to explain the differences between life insurance options, assisting users in making decisions aligned with their financial goals.

How to Use Fintechzoom to Find the Best Insurance

Access the Platform

- Visit the Website: Start your insurance search on Fintechzoom’s user-friendly website.

- Create an Account: Sign up with your details to manage insurance queries and policies.

Enter Personal Details and Insurance Requirements

- Provide Your Details: Enter relevant information such as age and location to receive tailored coverage options.

- Specify Your Needs: Clearly outline your insurance requirements—whether auto, home, health, or life insurance—to get suitable recommendations.

Compare Different Policies

- Utilize Comparison Tools: Compare various policies side by side, focusing on coverage limits, deductibles, premiums, and exclusions.

- Assess the Options: Take time to evaluate the advantages and disadvantages of each policy, with support from Fintechzoom’s insights.

Select and Purchase the Best Policy

- Choose the Ideal Policy: After a thorough comparison, select the policy that best meets your needs and budget.

- Complete the Purchase: Follow the platform’s steps to finalize your policy, with assistance for paperwork and payment.

Manage Your Policy

- Use Your Dashboard: Manage your insurance policies, process payments, and file claims through your Fintechzoom dashboard.

- Access Support: Contact Fintechzoom’s customer support for help with any issues or questions.

Enhanced Customer Satisfaction

- Personalized Solutions: Many users have expressed satisfaction with Fintechzoom’s ability to customize insurance solutions to individual needs. The platform’s flexibility and clarity have provided financial advantages and peace of mind.

Fintechzoom’s Partnerships with Leading Insurance Carriers

Fintechzoom’s alliances with top insurance carriers enhance its offerings, providing competitive rates and extensive coverage options. These partnerships ensure users receive optimal terms on their policies.

Benefits of Partnerships

- Competitive Rates: Fintechzoom negotiates directly with providers to secure better rates than those available to individual buyers.

- Wide Range of Coverage: Collaborations offer diverse coverage options and policy features.

- Quality Assurance: Each partner meets rigorous reliability and customer service standards, ensuring high-quality insurance products.

Conclusion

Fintechzoom represents a significant advancement in the insurance industry, combining user-friendly technology with extensive educational resources.

The platform’s focus on transparency, customization, and customer satisfaction positions it as a leading choice for securing reliable insurance coverage.

For your next insurance purchase, consider Fintechzoom for a comprehensive and supportive approach to finding the best coverage for your needs.

FAQs: Fintechzoom Best Insurance

1. What is Fintechzoom?

Fintechzoom is a digital platform designed to simplify the process of selecting and comparing insurance policies. It offers a user-friendly interface that allows individuals to compare rates, coverage options, and terms across various types of insurance, including auto, home, health, and life insurance.

2. How does Fintechzoom help with choosing insurance?

Fintechzoom helps users by providing clear comparisons of different insurance policies, breaking down complex terminology into understandable terms, and offering detailed insights into coverage options.

3. Is Fintechzoom’s insurance platform easy to use?

Yes, Fintechzoom is designed with an intuitive interface that caters to users of all technical skill levels.

4. Can I customize my insurance policy through Fintechzoom?

Absolutely. Fintechzoom allows users to customize their insurance policies to fit their specific needs.

5. How does Fintechzoom ensure the accuracy of insurance information?

Fintechzoom partners with reputable insurance carriers and uses up-to-date data to provide accurate comparisons and details.

6. Are there any discounts available through Fintechzoom?

Yes, Fintechzoom offers various discounts through its partnerships with insurance carriers. These may include discounts for vehicles with advanced safety features, safe driving records, and other criteria.

7. How do I manage my insurance policy on Fintechzoom?

After purchasing an insurance policy through Fintechzoom, you can manage it via your user dashboard. This includes processing payments, filing claims, and accessing customer support.

8. Is my personal information safe with Fintechzoom?

Fintechzoom prioritizes the security and privacy of user information. The platform employs robust security measures and encryption protocols to protect personal data and ensure a secure user experience.