Introduction

Fintechzoom Apple Stock: Apple Inc. (AAPL) stands as a titan in the technology sector, recognized globally for its innovation and influential products. Founded in 1976 by Steve Jobs, Steve Wozniak, and Ronald Wayne, Apple has evolved from a modest start-up into a multibillion-dollar enterprise.

Known for its flagship products such as the iPhone, iPad, MacBook, and Apple Watch, the company has consistently set benchmarks in design, technology, and customer satisfaction. As of today, Apple Inc. holds a significant market share, contributing notably to the global economy.

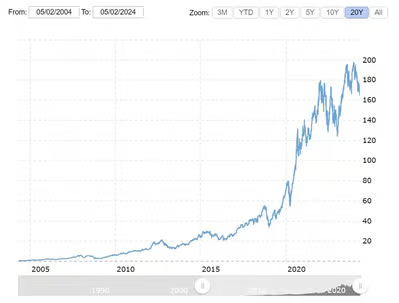

The historical performance of Fintechzoom Apple Stock has been remarkable. Over the years, it has shown consistent growth, rewarding its investors with substantial returns. The stock’s resilience and ability to adapt to market trends have made it a staple in many investment portfolios.

Apple’s financial health, characterized by steady revenue streams and strong profit margins, underscores its market significance. The company’s strategic initiatives, like expanding its services segment and venturing into new technologies, further bolster its stock’s appeal to investors.

Apple Stock and FintechZoom

FintechZoom, a prominent financial technology news platform, plays a crucial role in offering in-depth stock analysis and predictions. Known for its credible and timely information, FintechZoom has become a go-to source for investors seeking actionable insights.

The platform’s expertise in financial analysis, combined with its comprehensive coverage of market trends, makes it a reliable resource for understanding stock movements and making informed investment decisions.

Stock forecasts, especially for a company like Apple, are essential for investors. They provide a glimpse into potential future performance, helping investors strategize and optimize their portfolios. Given Apple’s substantial impact on the tech industry and the global market, its stock is a focal point for many investors.

Accurate predictions and thorough analyses offered by platforms like FintechZoom can significantly influence investment choices, underscoring the importance of reliable stock forecasts.

The Past Stock Performance of Apple

Apple’s historical stock performance throughout the years has shown an impressive trajectory characterised by steady growth and fortitude in the face of market swings. The Fintechzoom analysis of Apple’s stock shows an upward trend spanning ten years, demonstrating Apple’s resilience to market fluctuations.

Apple’s creative goods and solid financials are reflected in the stock’s remarkable performance. Numerous elements, such as successful product introductions, strong sales numbers, and wise business decisions, have contributed to Apple’s stock price’s steady rise.

Investor confidence and market sentiment have been observed by investors who are following Fintechzoom apple stock. This is due to Apple’s past performance. The thorough coverage of Apple’s earnings releases has shed light on the company’s financial situation and prospects going forward, which has helped to explain the stock’s overall upward trend.

Apple’s past stock performance confirms the company’s capacity to provide value to its stockholders in the face of shifting market conditions as it continues to grow and diversify its product and service offerings.

FintechZoom’s Apple Stock Prediction for the Near Future

FintechZoom’s recent analysis provides a detailed forecast for Apple stock in the near term, amidst a backdrop of dynamic market conditions and evolving economic factors.

The platform’s financial experts emphasize that Apple’s current product line, including the latest iterations of the iPhone, iPad, MacBook, and Apple Watch, continues to exhibit strong sales performance. Moreover, FintechZoom points to the company’s commitment to innovation as a key factor driving its stock’s resilience and potential growth.

One significant trend highlighted by FintechZoom is the increasing consumer adoption of Apple’s services ecosystem, which includes Apple Music, Apple TV+, and the App Store. This diversification beyond hardware sales is expected to bolster Apple’s revenue streams, thereby positively influencing its stock performance.

Additionally, the integration of advanced technologies like augmented reality (AR) and artificial intelligence (AI) into Apple’s products is seen as a strategic move to maintain its competitive edge in the tech industry.

Market Competition

Market competition remains a critical factor in FintechZoom’s short-term predictions. While Apple faces stiff competition from other tech giants like Samsung and Google, its strong brand loyalty and customer base provide a solid foundation for continued market dominance.

FintechZoom also notes that Apple’s strategic moves, such as expanding its presence in emerging markets and investing in sustainable practices, are likely to enhance its market position and attract environmentally conscious investors.

Economic Conditions

However, pose a mixed bag for Apple’s stock outlook. FintechZoom acknowledges that global supply chain disruptions and inflationary pressures could pose challenges.

Nevertheless, Apple’s robust financial health, characterized by a strong balance sheet and substantial cash reserves, equips it to navigate these uncertainties effectively. Furthermore, any economic recovery or stabilization could act as a catalyst for renewed investor confidence.

In essence, FintechZoom’s near-term prediction for Apple stock incorporates a multifaceted analysis of market trends, competitive dynamics, and economic conditions. By leveraging its strengths in innovation and market adaptability, Apple is poised to sustain its stock performance, with potential for modest growth in the coming months to a year.

FintechZoom’s Apple Stock Forecast for 2025

FintechZoom’s analysis of Apple’s stock trajectory by 2025 presents a multifaceted outlook, reflecting both opportunities and potential hurdles. The forecast anticipates sustained growth driven by several key factors.

Product Innovation

Firstly, product innovation remains at the core of Apple’s strategy. The introduction of new devices, including advancements in augmented reality (AR) and virtual reality (VR) technologies, could significantly boost revenue streams.

The anticipated launch of AR glasses and improvements in the existing product lines are expected to drive consumer demand and market expansion.

Technological Advancements

Technological advancements also play a pivotal role in FintechZoom’s projections. The development of Apple’s proprietary silicon chips, such as the M-series processors, promises to enhance the performance and efficiency of their devices, potentially capturing a larger market share.

Furthermore, Apple’s expansion into new markets, particularly in emerging economies, represents a substantial growth opportunity. Strategic partnerships and collaborations, such as those in the healthcare sector, could further diversify Apple’s revenue base and mitigate risks.

However, FintechZoom also highlights several challenges that Apple may face. Economic forecasts suggest a potential slowdown in global growth, which could impact consumer spending. Regulatory changes, particularly those concerning data privacy and antitrust issues, may impose additional constraints on Apple’s operations.

Moreover, the competitive landscape is evolving with major technology companies continuously innovating, potentially intensifying market competition.

Despite these challenges, FintechZoom’s forecast remains optimistic about Apple’s stock performance. The company’s robust financial health, substantial cash reserves, and commitment to shareholder returns through dividends and buybacks provide a solid foundation.

In conclusion, while external factors and market dynamics play critical roles, Apple’s strategic initiatives and innovation-centric approach are likely to propel its stock value upwards by 2025.

FintechZoom’s Apple Stock Forecast for 2030

FintechZoom’s forecast for Apple stock leading up to 2030 reflects a comprehensive analysis of technological trends, macroeconomic factors, and industry shifts. According to their predictions, Apple is expected to leverage advancements in artificial intelligence, augmented reality, and 5G technology to maintain its competitive edge.

These innovations are projected to drive significant growth in Apple’s product lines, particularly in the realms of smart devices and wearable technology.

Macroeconomic factors will play a crucial role in shaping Apple’s future stock performance. FintechZoom anticipates that global economic stability, coupled with rising consumer spending, will bolster demand for premium products.

Additionally, Apple’s strategic investments in emerging markets are expected to expand its consumer base and diversify its revenue streams. This expansion is likely to mitigate risks associated with economic fluctuations in more mature markets.

Industry shifts, such as the increasing emphasis on sustainability and data privacy, are predicted to influence Apple’s business model.

FintechZoom suggests that Apple will continue to invest heavily in research and development to pioneer eco-friendly technologies and enhance security features across its ecosystem. These efforts are anticipated to strengthen brand loyalty and attract environmentally and privacy-conscious consumers.

Potential Disruptions

Including geopolitical tensions and regulatory changes, are also considered in FintechZoom’s forecast. While these factors pose challenges, Apple’s robust financial health and adaptive strategies are expected to enable it to navigate such uncertainties effectively. FintechZoom highlights Apple’s ability to innovate and adapt as key to its resilience and long-term growth.

Significant milestones projected by FintechZoom include the potential launch of revolutionary products and services, such as advanced AR glasses or a fully autonomous vehicle.

These innovations are seen as transformative events that could redefine consumer experiences and open new revenue channels for Apple. FintechZoom’s analysis underscores the importance of these developments in driving Apple’s stock performance toward 2030.

Where Will Apple Stock Be in 10 Years?

Analyzing Fintechzoom Apple Stock perspective reveals a multifaceted view on where Apple stock might be in the next decade. Historically, Apple Inc. has demonstrated a robust growth trajectory, consistently outperforming market expectations and setting new benchmarks in innovation and consumer technology.

This historical context provides a foundation for future projections, suggesting that Apple’s stock is likely to continue its upward momentum.

From a comparative standpoint, Apple’s growth trajectory can be aligned with other major tech companies such as Microsoft and Amazon. These companies have shown that sustained innovation and strategic market positioning can lead to long-term stock appreciation.

Assuming Apple maintains its current pace of innovation and market presence, it is plausible that the stock could see substantial gains over the next ten years.

In a Best-Case Scenario

Apple could capitalize on new technological advancements, such as artificial intelligence, augmented reality, and autonomous systems. These innovations could open new revenue streams and enhance existing product lines, driving the stock to unprecedented heights.

Furthermore, Apple’s growing focus on services, including Apple Music, Apple TV+, and iCloud, could provide a steady stream of recurring revenue, contributing to overall financial stability and stock performance.

In a Worst-Case Scenario

Conversely, a worst-case scenario might involve increased competition, market saturation, or unforeseen global economic challenges. These factors could potentially hinder Apple’s growth, leading to slower stock appreciation or even declines.

However, given Apple’s strong brand loyalty and diversified product portfolio, it is likely that the company would still maintain a significant market presence even in adverse conditions.

Anticipated societal and technological changes will undoubtedly play a crucial role in shaping Apple’s future market presence and stock performance.

As digital transformation accelerates, Apple’s ability to adapt and innovate will be critical. The company’s ongoing investments in research and development suggest a commitment to staying at the forefront of technological advancements, which bodes well for long-term stock performance.

Conclusion

As we have explored, the future of Fintechzoom Apple Stock is shaped by a multitude of factors ranging from technological innovation to market dynamics.

The insights provided by FintechZoom underscore the importance of staying well-informed through reliable sources when contemplating investment decisions. Apple, as a frontrunner in the tech industry, presents both opportunities and risks that investors need to carefully weigh.

Predictions and forecasts indicate that while Apple continues to innovate and expand its market reach, external factors such as economic conditions and competitive pressures could influence its stock performance.

The company’s commitment to developing new technologies, alongside its robust financial health, positions it favorably in a rapidly evolving market. However, potential risks, including regulatory challenges and market saturation, should not be overlooked.

To Navigate the Complexities of Investing in Apple stock

It is crucial for investors to conduct their own thorough research and remain up-to-date with the latest analyses and trends. Consulting reliable sources like FintechZoom can provide valuable insights into market movements and predictions, aiding in more informed decision-making processes.

Furthermore, considering professional financial advice can help in tailoring investment strategies to individual financial goals and risk tolerance.

Ultimately, while Apple’s stock holds significant promise, the decision to invest should be grounded in a comprehensive understanding of both current conditions and future projections. By staying informed and critically evaluating the provided forecasts, investors can better position themselves to capitalize on potential opportunities while mitigating associated risks.

Frequently Asked Questions

How can Fintechzoom help me invest in Apple stock?

Fintechzoom offers tools, such as real-time price updates, historical data analysis, and expert discussion, for tracking the performance of Apple’s stock. Investors can use this information to better understand market trends and choose wisely when making investments.

Why is Apple considered a good investment?

Because of its creative product line, strong brand devotion, stable financial position, and steady ability to adjust to market changes, Apple is regarded as an excellent investment. Stable growth and possible long-term gains are facilitated by these variables.

How does Fintechzoom gather its data?

To ensure thorough and reliable information, Fintechzoom collects its data from a variety of sources, including financial databases, market reports, direct feeds from stock exchanges, and professional evaluations.

What is the Apple stock prediction for 2030?

By 2030, Apple’s market value might reach $8.7 trillion, or $561 per share. That is a 232% increase over the current price. Strong Buy Rating: We think AAPL shares are a strong buy based on our prediction for Apple’s stock price.

Can Apple stock reach $1000?

Although it is theoretically feasible, continuous excellent financial performance, effective market penetration and expansion, and a favourable economic climate are all necessary for Apple’s stock to reach $1000 per share in the future.