Role of Insurance in Financial Planning: In the ever-changing landscape of personal finance, achieving long-term stability requires more than just saving and investing.

Financial planning is a comprehensive process that helps individuals and families navigate life’s uncertainties while working toward their goals.

At the heart of any robust financial plan lies insurance, a critical tool that protects against unforeseen events, safeguards assets, and ensures financial continuity.

From securing a family’s future to preserving wealth, insurance plays an indispensable role in mitigating risks and fostering financial well-being.

This article delves into the multifaceted importance of insurance in financial planning and highlights how it empowers individuals to prepare for the unexpected while pursuing their aspirations.

Understanding Financial Planning

Financial planning is a strategic process that involves managing your income, expenses, savings, and investments to achieve both short-term and long-term financial goals.

It provides a structured framework for navigating life’s uncertainties while ensuring financial stability.

A comprehensive financial plan considers various aspects, such as budgeting, debt management, retirement savings, and wealth creation. It also incorporates risk mitigation strategies, like insurance, to protect against unforeseen events.

By aligning financial decisions with personal objectives, financial planning empowers individuals and families to secure their future, maintain their lifestyle, and confidently work toward milestones like homeownership, education funding, and a comfortable retirement.

Also read: Do You Need Renters Insurance? Here’s Why It’s Worth It: 5 Essential Key Points

Why Insurance is Integral to Financial Planning

Insurance provides a safety net that protects against financial disruptions caused by unexpected events. Without adequate insurance coverage, individuals and families risk depleting their savings or going into debt during crises.

Here are the primary reasons why insurance is essential:

- Risk Mitigation Life is unpredictable. Insurance helps to mitigate risks associated with events such as illness, accidents, or natural disasters. By transferring the financial burden to an insurance provider, individuals can focus on recovery and rebuilding rather than worrying about financial strain.

- Asset Protection Valuable assets, such as homes, vehicles, and businesses, require protection against damage or theft. Insurance ensures these assets are preserved, even in the face of unforeseen circumstances.

- Income Replacement In cases of disability, critical illness, or the loss of a breadwinner, insurance policies provide income replacement to maintain the family’s standard of living.

- Legacy Planning Life insurance plays a pivotal role in legacy planning by ensuring that loved ones are financially secure after one’s passing. This includes covering funeral costs, debts, and providing an inheritance.

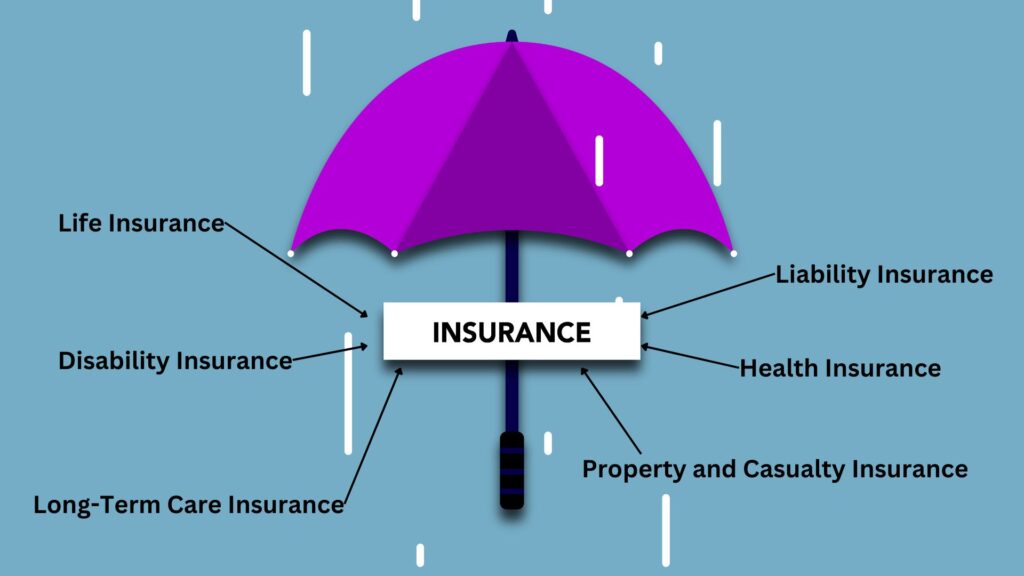

Types of Insurance in Financial Planning

1. Life Insurance

Life insurance ensures financial security for dependents in case of premature death. It comes in various forms, including:

- Term Life Insurance: Offers coverage for a specific period and is generally more affordable.

- Whole Life Insurance: Provides lifelong coverage and includes a savings component.

- Universal Life Insurance: Combines life insurance with investment options for greater flexibility.

2. Health Insurance

Healthcare costs can be overwhelming without adequate coverage. Health insurance reduces the burden of medical expenses, including hospitalization, surgeries, and medications. It also offers preventive care, helping policyholders maintain overall well-being.

3. Disability Insurance

Disability insurance replaces lost income if an individual becomes unable to work due to injury or illness. This ensures financial stability during periods of incapacity.

4. Property and Casualty Insurance

These policies cover physical assets like homes, cars, and businesses against damage, theft, or liability claims. Homeowner’s insurance, for example, is critical for protecting one of the most significant investments people make in their lifetime.

5. Long-Term Care Insurance

As life expectancy increases, the need for long-term care also grows. This insurance covers expenses associated with assisted living, nursing homes, and in-home care.

6. Liability Insurance

Liability insurance protects against legal claims and damages, providing coverage for accidents, injuries, or negligence lawsuits.

The Financial Benefits of Insurance

1. Encouraging Savings and Investments

Certain insurance products, such as whole life or endowment policies, combine protection with a savings element. These products encourage disciplined saving habits while ensuring the policyholder is covered against risks.

2. Tax Advantages

Many insurance policies come with tax benefits under various laws, providing additional incentives for individuals to secure coverage.

3. Peace of Mind

Knowing that potential financial challenges are addressed through insurance allows individuals to focus on their personal and professional goals without constant worry.

Insurance as a Tool for Wealth Preservation

Role of Insurance in Financial Planning: Insurance serves as a powerful tool for preserving wealth by protecting against unexpected financial setbacks that could erode accumulated assets.

For high-net-worth individuals, policies such as umbrella insurance provide an extra layer of liability coverage, safeguarding wealth from lawsuits or significant claims.

Similarly, key-person insurance ensures business continuity by compensating for the loss of critical personnel, protecting the enterprise’s value.

Products like whole life insurance offer dual benefits of protection and savings, allowing policyholders to grow their wealth while maintaining a safety net.

By addressing risks that could otherwise drain resources, insurance becomes a cornerstone of long-term financial stability and wealth preservation.

How to Integrate Insurance into Financial Planning

Integrating insurance into your financial planning begins with a thorough assessment of your risks and financial priorities. Start by evaluating your life stage, family needs, health status, and assets to identify areas that require protection.

Next, define your short-term and long-term financial goals, such as saving for retirement, funding education, or ensuring income replacement.

Choose insurance policies that align with these objectives, ensuring they provide adequate coverage without exceeding your budget.

For example, life insurance can secure your family’s future, while health and disability insurance protect against medical and income-related risks.

Regularly review and update your policies to adapt to life changes, such as marriage, having children, or career advancements. By making insurance a core component of your financial plan, you create a safety net that supports growth and stability.

- Assess Your Risks Begin by evaluating the risks you face based on age, family situation, health, and occupation.

- Define Financial Goals Identify both short-term and long-term financial objectives, such as buying a home, funding education, or retirement planning.

- Choose Appropriate Policies Select insurance policies that align with your goals and provide adequate coverage without straining your budget.

- Review and Update Regularly As life circumstances change, it’s essential to review and adjust your insurance coverage to ensure it remains relevant and sufficient.

Common Mistakes to Avoid

When incorporating insurance into your financial planning, certain mistakes can undermine your efforts to secure financial stability.

Underinsurance is a prevalent issue, leaving individuals inadequately protected against significant risks. Conversely, overinsurance can strain your budget by allocating funds to unnecessary coverage.

Another common pitfall is failing to read policy details carefully, which can lead to unpleasant surprises when claims are denied due to exclusions or limitations.

Many people also neglect to review and update their policies periodically, resulting in outdated coverage that no longer meets their needs.

Avoid these missteps by conducting thorough research, understanding policy terms, and ensuring your insurance strategy aligns with your financial goals.

Conclusion

The Role of Insurance in Financial Planning: Incorporating insurance into financial planning is not merely a precaution but a strategic decision that underpins long-term financial security.

It acts as a shield against life’s uncertainties, ensuring that individuals and families can navigate challenges without compromising their goals.

Whether it’s protecting assets, replacing income, or providing a legacy for loved ones, the value of insurance cannot be overstated.

By understanding its role and integrating it into a broader financial strategy, individuals can build a foundation for stability, growth, and peace of mind. Let insurance be the cornerstone of your financial plan, empowering you to face the future with confidence and resilience.

FAQs: Role of Insurance in Financial Planning

1. What is the role of insurance in financial planning?

Insurance plays a vital role in financial planning by providing protection against unexpected risks, ensuring financial stability, and safeguarding assets. It helps mitigate potential financial losses and secures long-term financial goals.

2. How does life insurance contribute to financial planning?

Life insurance provides financial security for dependents in case of premature death, covers debts, and ensures an inheritance or legacy. It also serves as a tool for wealth preservation and savings.

3. What types of insurance should be included in a financial plan?

Key types of insurance include life insurance, health insurance, disability insurance, property and casualty insurance, liability insurance, and long-term care insurance. The choice depends on individual needs and risks.

4. How does insurance help in wealth creation?

Certain insurance products, like whole life insurance or endowment plans, combine risk coverage with investment opportunities, encouraging disciplined savings while providing financial protection.

5. Can insurance provide tax benefits?

Yes, many insurance policies offer tax advantages under various regulations, allowing policyholders to save on taxes while securing comprehensive coverage.