Understanding AMC Stock

Fintechzoom AMC Stock: AMC Entertainment Holdings, Inc. (AMC) has garnered significant attention in the stock market, evolving from a traditional cinema chain to a prominent subject of retail investor interest. Founded in 1920, AMC has grown to become one of the largest movie theater chains globally, with a strong presence in the United States and Europe.

Historically, AMC’s stock performance has been relatively stable, reflecting the company’s steady revenue from its theater operations.

The company faced substantial challenges during the COVID–19 pandemic, as widespread lockdowns and social distancing measures led to the closure of theaters and a sharp decline in revenue. This period saw AMC’s stock price plummet, causing concern among investors about the company’s future viability.

However, AMC leveraged this adversity to pivot its strategy, embracing digital initiatives and exploring new revenue streams, which gradually restored investor confidence.

An Overview

A major turning point for AMC came in early 2021, when it became a focal point for retail investors, largely driven by discussions on social media platforms and forums, notably Reddit’s WallStreetBets. This surge in interest transformed AMC into a “meme stock,” characterized by its volatile price movements and significant trading volumes.

Retail investors, often coordinated through platforms like FintechZoom, played a crucial role in driving up the stock price, which led to a short squeeze that caught the attention of the broader financial community.

AMC’s transformation from a struggling cinema chain to a symbol of retail investor power is a testament to the changing dynamics of the stock market. The company’s ability to navigate through financial turbulence and adapt to new market conditions has been instrumental in its recent resurgence.

As a result, AMC’s stock performance has become a barometer for retail investor sentiment and market trends, making it a subject of continuous analysis and speculation.

Key Players Behind AMC Stock

Investors wishing to understand the forces influencing market dynamics must decipher the complex web of AMC stock price movements and comprehend the major players behind AMC’s growth. Regarding AMC Entertainment Holdings, the retail investor community has become a powerful force.

These individual investors have demonstrated a significant capacity to collectively affect stock prices. They frequently coordinate and communicate through online venues such as Reddit’s WallStreetBets. The price increase of AMC shares has been largely attributed to their coordinated purchase and holding of the company’s stock.

Institutional investors, including big financial institutions and hedge funds, are also very important to AMC’s growth. Whether they buy more stock or engage in short selling, their activities can have a significant effect on the market.

Who Owns AMC Shares?

Understanding the ownership structure of AMC shares is crucial for evaluating the company’s prospects. AMC Entertainment Holdings Inc., known for its extensive chain of movie theaters, has a diverse shareholder base comprising institutional investors, retail investors, and significant individual shareholders.

Institutional investors hold a substantial portion of AMC’s shares, reflecting confidence from large investment funds and financial institutions. These include mutual funds, pension funds, and hedge funds, which collectively own a significant percentage of the company’s stock.

Notable institutional investors in AMC include Vanguard Group, BlackRock, and State Street Corporation. This substantial institutional ownership can provide stability to the stock, as these investors typically have long-term investment horizons and considerable resources for in-depth financial analysis.

Retail investors also play a pivotal role in AMC’s ownership structure. The “meme stock” phenomenon, which gained traction in early 2021, saw an in flux of individual investors rallying around AMC. These retail investors, often organized via social media platforms like Reddit, have significantly influenced the stock’s market dynamics.

Their collective buying and holding strategies have led to increased volatility but also to notable spikes in the stock price, sometimes contrary to traditional market expectations.

Significant Individual Shareholders

Significant individual shareholders, including AMC’s executives and board members, also hold noteworthy stakes in the company. These insiders’ investment in the firm can be interpreted as a vote of confidence in AMC’s business strategy and future growth potential.

For instance, CEO Adam Aron has been a prominent figure, both in terms of operational leadership and stock ownership, further aligning management’s interests with those of shareholders.

Recent changes in ownership have also impacted AMC’s stock performance and market perception. For example, fluctuations in institutional holdings can signal shifts in market sentiment, while movements in retail investor activities can lead to considerable short-term price changes.

Understanding these dynamics is essential for anyone analyzing AMC’s stock, as the interplay between different types of investors can significantly influence its market trajectory.

AMC Stock Projections: What Will It Be Worth in 5 Years?

In analyzing the future value of AMC stock over the next five years, expert forecasts and analytical predictions paint a multifaceted picture. Several factors are pivotal in shaping these projections, including market trends, company strategies, and broader economic conditions.

Market trends play a significant role in determining the trajectory of AMC’s stock. As the entertainment sector undergoes rapid evolution, driven by technological advancements and shifting consumer preferences, AMC’s adaptability to these changes will be crucial.

The increasing popularity of streaming services poses a substantial challenge to traditional cinema, yet it also presents opportunities for AMC to innovate and diversify its offerings. Strategic partnerships and expansions into digital platforms could thus positively influence its stock value.

Company Strategies are Another Critical Determinant

AMC’s recent initiatives, such as upgrading theater experiences with premium formats and enhancing customer loyalty programs, aim to attract and retain a broader audience. Additionally, the company’s efforts to manage its debt and improve financial health are vital components of its long-term growth strategy.

Successful execution of these plans could bolster investor confidence and contribute to a positive stock outlook. External economic conditions cannot be overlooked when projecting AMC’s future stock value. Economic stability, consumer spending power, and interest rates will invariably impact the entertainment industry.

A robust economy typically translates to higher disposable incomes, thereby increasing consumer spending on leisure activities like movie-going. Conversely, economic downturns can dampen these expenditures, potentially affecting AMC’s revenue streams and stock performance.

Examining Historical Performance

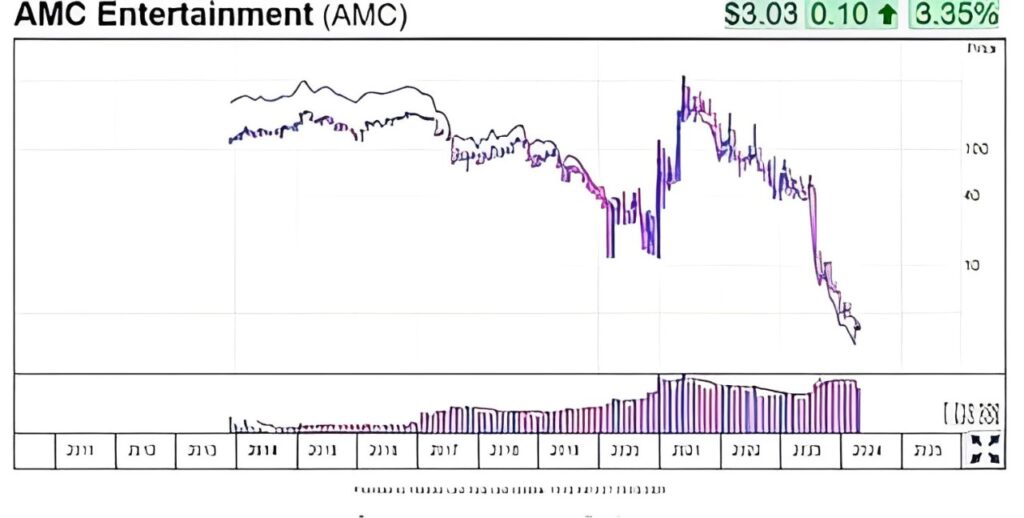

Examining historical performance provides valuable insights. Fintechzoom AMC Stock has experienced significant volatility, influenced by market dynamics and company-specific events.

Comparative analysis with other stocks in the entertainment sector reveals that while some peers have thrived amid the streaming revolution, AMC’s traditional business model has faced more significant challenges. Nonetheless, the company’s proactive measures and resilience suggest potential for recovery and growth.

In summary, the future value of AMC stock is contingent upon a complex interplay of market trends, strategic initiatives, and economic conditions. While uncertainties remain, a balanced approach that capitalizes on emerging opportunities and mitigates risks could enhance AMC’s prospects over the next five years.

Fintechzoom AMC Stock: 2024, 2025, and 2030

The future trajectory of AMC stock remains a subject of intense scrutiny and speculation. Financial analysts have put forward various projections for the years 2024, 2025, and 2030, each incorporating a range of factors from market trends to industry developments.

Understanding these projections and the assumptions behind them is crucial for investors looking to make informed decisions.

AMC Stock Forecast 2024

For 2024, analysts forecast that AMC stock may experience moderate growth. This optimism is predicated on the anticipated recovery of the entertainment industry post-pandemic. The gradual reopening of theaters and the release of blockbuster films are expected to drive revenue growth.

However, the resurgence of streaming services and changes in consumer behavior could temper these gains. Analysts emphasize the importance of AMC’s strategic initiatives to diversify its revenue streams, such as its foray into the retail popcorn business and potential partnerships with streaming platforms.

AMC Stock Forecast 2025

Moving to 2025, projections are mixed but cautiously optimistic. By this time, AMC’s efforts to reduce debt and improve its financial health could begin to bear fruit. Analysts suggest that if AMC successfully capitalizes on new revenue opportunities and adapts to evolving market conditions, the stock could see more substantial growth.

Conversely, any setbacks in these strategic initiatives or a slower-than-expected recovery in theater attendance could hinder progress. The credibility of these forecasts largely depends on AMC’s ability to navigate an unpredictable market landscape and maintain its competitive edge.

AMC Stock Forecast 2030

Looking further ahead to 2030, long-term forecasts for AMC stock are inherently more speculative. Analysts predict that technological advancements and shifts in consumer preferences will significantly reshape the entertainment industry. AMC’s adaptability to these changes will be a critical determinant of its stock performance.

Potential scenarios include a thriving AMC that has successfully integrated diverse entertainment options, or a company struggling to compete in a digital-first world. The assumptions underlying these forecasts hinge on AMC’s strategic agility and the broader industry’s evolution.

The price of AMC is expected to reach-

| Year | Price |

|---|---|

| 2024 | $9 |

| 2025 | $12 |

| 2026 | $15 |

| 2027 | $17 |

| 2028 | $20 |

| 2029 | $30 |

| 2030 | $35 |

Was AMC Bought by China?

Over the years, AMC Entertainment Holdings, Inc. has been subject to numerous speculations regarding its ownership, particularly concerning Chinese investment. The most notable acquisition took place in 2012 when the Chinese conglomerate Dalian Wanda Group acquired a majority stake in AMC.

This purchase marked a significant milestone in the cinema industry, as it was one of the largest takeovers by a Chinese company in the U.S. media and entertainment sector.

Dalian Wanda Group’s involvement brought substantial changes to AMC, including capital investments and operational strategies aimed at expanding the chain’s footprint and enhancing its technological offerings.

The Chinese conglomerate’s ownership helped AMC navigate through various economic challenges and positioned it as a leader in the global cinema market.

As Market Dynamics Evolved

Dalian Wanda Group began reducing its stake in AMC. By 2018, Wanda had significantly decreased its ownership, eventually relinquishing majority control. Currently, Wanda holds a minority interest, and AMC’s ownership is predominantly diverse, with significant stakes held by institutional investors and individual shareholders.

The initial acquisition by the Dalian Wanda Group raised concerns about foreign influence over an iconic American brand. Critics speculated on potential impacts on AMC’s operational decisions, content policies, and strategic direction.

Nevertheless, evidence suggests that AMC maintained a degree of autonomy, continuing to operate under its established brand identity and business model.

The impact of Chinese ownership on AMC’s stock performance has been a mix of positive and negative trends. The initial capital infusion from Wanda was beneficial, enabling expansion and technological upgrades.

Nevertheless, as Wanda reduced its stake, market perceptions shifted, influencing stock volatility. Investors have closely monitored AMC’s strategic moves and financial health, particularly in light of the global pandemic’s impact on the entertainment industry.

Conclusion

while the Chinese conglomerate Dalian Wanda Group once held a significant majority stake in Fintechzoom AMC Stock, the current ownership landscape is much more diversified. The legacy of this investment, however, continues to influence perceptions and strategic decisions within AMC, shaping its future trajectory in the ever-evolving cinema industry.

The value of AMC Entertainment Holdings, Inc. extends beyond its stock price, encompassing a multifaceted assessment of its market capitalization, assets, liabilities, revenue streams, and overall profitability. As of the latest financial reports, AMC’s market capitalization stands as a critical indicator of its perceived value in the market.

Market capitalization, calculated by multiplying the current stock price by the total number of outstanding shares, provides a snapshot of investor sentiment and potential growth prospects.

Revenue Streams Form Another Pillar of AMC’s Value

Traditionally reliant on box office sales, AMC has diversified its revenue streams to include concessions, on-demand streaming services, and various partnership agreements. This diversification strategy is pivotal in adapting to the dynamic landscape of the entertainment industry, where consumer preferences are rapidly evolving.

Strategic initiatives are equally paramount when evaluating AMC’s future value. The company has embarked on several forward-looking projects, such as expanding its footprint in international markets and enhancing the customer experience through technological upgrades. These endeavors aim to fortify AMC’s competitive positioning and unlock new growth avenues.

In the broader context of the entertainment industry, AMC’s value is also influenced by its ability to navigate competitive pressures and capitalize on emerging trends. For instance, the rise of streaming platforms presents both challenges and opportunities.

By leveraging its established brand and exploring synergies with digital platforms, AMC is well-positioned to adapt and thrive in this evolving landscape.

Frequently Asked Questions

What is the prediction for Fintechzoom AMC Stock?

The price of AMC is expected to reach $9 by the end of 2024 and $12 by the end of 2025, based on the most recent long-term forecast. In 2026, AMC will reach $15; in 2027, $17; in 2028, $20; in 2029, $30; in 2030, and $35 in 2034.

How many AMC shares exist?

As per the most recent financial reports and stock price, AMC Entertainment presently has 263,411,000 outstanding shares. The corporation has 263,411,000 outstanding shares at the end of 2024.

Does the Fintechzoom Platform Select Which AMC Stock News to Cover?

Platforms frequently give importance, impact, and timeliness top priority when choosing which AMC stock news to cover. The selection process is guided by various factors, including audience interest, corporate performance, and market trends, to ensure the delivery of valuable and informative content.

Are There Any Regulatory Concerns Associated With Fintechzoom’s Reporting on AMC Stock?

Reports from media sources that can have an impact on stock prices could raise regulatory issues. It is crucial to prioritize accuracy, transparency, and ethical issues. Regulatory agencies keep an eye on things to ensure integrity in financial reporting, fair markets, and investor protection.

How Does Fintechzoom Make Sure That Reports About AMC Stock Are Accurate and Objective?

Thorough fact-checking, verification from several sources, adherence to journalistic ethics, avoiding conflicts of interest, and transparency in reporting processes are all necessary to ensure accurate and balanced reporting. When it comes to journalism, objectivity and honesty must always be upheld.